Forex profit targets are a crucial aspect of successful Forex trading, empowering traders to define their goals, manage risk, and maximize their earnings. This comprehensive guide will delve into the intricacies of profit targets, exploring their types, strategies, and best practices to help you elevate your trading performance.

By understanding the significance of profit targets and implementing effective strategies, you can harness their power to enhance your trading outcomes and achieve your financial aspirations.

Forex profit targets are crucial for managing risk and maximizing returns. While various strategies exist, Forex momentum trading is a popular approach that identifies trends and capitalizes on price movements.

By utilizing technical indicators and market analysis, momentum traders aim to enter and exit trades at optimal times, maximizing their profit potential within defined target ranges.

1. Define Forex Profit Targets

In Forex trading, profit targets are predetermined price levels at which a trader aims to close their positions and secure their profits. They play a crucial role in managing risk, protecting capital, and maximizing returns.

Importance of Setting Profit Targets

Setting profit targets is essential for several reasons:

-

- Risk Management: Profit targets limit potential losses by establishing a clear exit point.

- Capital Protection: By taking profits at predefined levels, traders safeguard their capital from adverse market movements.

- Profit Maximization: Profit targets ensure that traders capture a reasonable portion of their potential profits without holding positions indefinitely.

Common Profit Targets, Forex profit targets

-

-

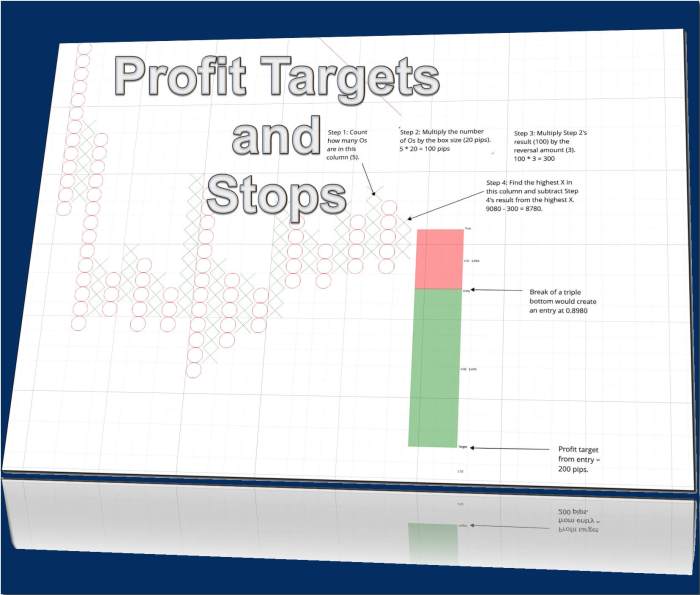

- Fixed Targets: A specific price level at which the position is closed, regardless of market conditions.

- Trailing Stops: Dynamic targets that move with the market price, locking in profits while allowing for potential further gains.

- Profit-to-Risk Ratios: A calculation that determines the amount of profit a trader aims to make in relation to the risk they are taking.

-

Closure

In conclusion, Forex profit targets are an indispensable tool for Forex traders, providing a roadmap for achieving trading objectives while mitigating risks.

By embracing the principles Artikeld in this guide, you can develop a robust profit target strategy that aligns with your risk tolerance, trading style, and market dynamics.

Remember, discipline, consistency, and a deep understanding of profit targets are the keys to unlocking the full potential of your Forex trading endeavors.

Setting realistic profit targets is crucial in Forex trading. However, it’s equally important to understand the psychological aspects of trading.

Forex trading psychology plays a significant role in decision-making, risk management, and overall trading performance. By managing emotions and developing a disciplined approach, traders can better navigate market fluctuations and achieve their profit targets.

Clarifying Questions: Forex Profit Targets

What are the key considerations when setting Forex profit targets?

When setting profit targets, it’s essential to consider your risk tolerance, trading strategy, and prevailing market conditions. These factors will influence the optimal profit target levels for your trades.

How do trailing stops differ from fixed profit targets?

When setting profit targets in Forex trading, traders often rely on technical analysis to identify potential areas of resistance and support.

By studying Forex trading patterns , traders can gain insights into the market’s behavior and make informed decisions about where to place their profit targets.

Understanding these patterns can help traders maximize their profits while minimizing their risks.

Trailing stops are dynamic profit targets that automatically adjust based on market movements. They are designed to lock in profits while allowing trades to run longer in favorable market conditions.

Fixed profit targets, on the other hand, are static and do not adjust to market fluctuations.

Why is it important to manage Forex profit targets?

Managing profit targets is crucial to protect your earnings and minimize losses. By adjusting profit targets based on market conditions and trading performance, you can optimize your trades and enhance your overall profitability.