Forex Trading Platforms Comparison – In the dynamic world of forex trading, choosing the right trading platform is crucial for success. A reliable platform provides access to markets, offers essential tools, and ensures a seamless trading experience. This article will compare popular forex trading platforms, highlighting their features, advantages, and suitability for different types of traders.

Understanding Forex Trading Platforms

A forex trading platform is software that allows traders to buy and sell currencies in the forex market. These platforms provide real-time market data, charting tools, technical indicators, and various order types, enabling traders to execute trades efficiently.

Importance of Choosing the Right Platform

- User Experience: A user-friendly interface enhances trading efficiency.

- Access to Tools: Platforms with advanced tools can improve trading strategies.

- Reliability: A stable platform ensures minimal downtime and quick trade execution.

- Security: Protecting your data and funds is paramount.

Comparison of Popular Forex Trading Platforms

1. MetaTrader 4 (MT4)

Overview

MetaTrader 4 (MT4) is one of the most widely used trading platforms in the forex market. It is known for its user-friendly interface, advanced charting capabilities, and extensive range of technical indicators.

Key Features

- Customizable Charts: Offers various chart types and timeframes for in-depth analysis.

- Automated Trading: Supports Expert Advisors (EAs) for algorithmic trading.

- Mobile Trading: Available on mobile devices for trading on the go.

- Community Support: Large online community provides resources and plugins.

Pros and Cons

- Pros:

- User-friendly interface

- Extensive indicator library

- Strong community support

- Cons:

- Limited advanced order types

- MT4 is primarily focused on forex, with less support for other asset classes.

2. MetaTrader 5 (MT5)

Overview

MetaTrader 5 (MT5) is the successor to MT4, offering additional features and improved functionality. It supports more asset classes, including stocks and commodities.

Key Features

- More Order Types: Includes additional pending order types for flexibility.

- Economic Calendar: Integrated calendar for tracking economic events.

- Improved Charting Tools: Advanced charting options and timeframes.

- Multi-Asset Trading: Allows trading of forex, stocks, and futures.

Pros and Cons

- Pros:

- Enhanced analytical tools

- Greater asset diversity

- Built-in economic calendar

- Cons:

- Slightly steeper learning curve for new users

- Some features may be overwhelming for beginners.

3. cTrader

Overview

cTrader is known for its intuitive interface and powerful trading features. It is popular among both retail and institutional traders.

Key Features

- User-Friendly Interface: Clean design and easy navigation.

- Advanced Charting: Offers a wide range of charting tools and indicators.

- Level II Pricing: Provides access to market depth for better trade execution.

- Automated Trading: Supports cAlgo for algorithmic trading.

Pros and Cons

- Pros:

- Sleek and modern interface

- Access to market depth information

- Comprehensive trading tools

- Cons:

- Less popular than MT4/MT5, resulting in fewer third-party plugins.

- Limited availability with some brokers.

4. NinjaTrader

Overview

NinjaTrader is a popular platform, especially among futures and forex traders. It offers advanced charting and trading tools.

Key Features

- Market Analysis Tools: Extensive analysis tools and indicators for trading strategies.

- Customizable Interface: Highly customizable layout for personalized trading experiences.

- Backtesting Capabilities: Allows traders to test strategies against historical data.

- Advanced Order Types: Supports various order types and risk management features.

Pros and Cons

- Pros:

- Robust analysis and backtesting features

- Highly customizable

- Strong community support

- Cons:

- Can be complex for beginners

- Some advanced features may require additional fees.

5. TradingView

Overview

TradingView is a web-based platform known for its social trading features and powerful charting tools. While it is not exclusively a trading platform, it offers integration with brokers for executing trades.

Key Features

- Social Trading: Engage with a community of traders and share ideas.

- Advanced Charting Tools: Highly customizable charts with numerous indicators.

- Screener Tools: Built-in tools for screening stocks and forex pairs.

- Multi-Device Access: Accessible from any device with internet connectivity.

Pros and Cons

- Pros:

- Excellent charting capabilities

- Active community for sharing strategies

- Accessible from anywhere

- Cons:

- Not a full-fledged trading platform (depends on broker integration).

- Some advanced features require a paid subscription.

How to Choose the Right Forex Trading Platform

Consider Your Trading Style

- Scalpers and Day Traders: Look for platforms with fast execution speeds and advanced charting tools.

- Swing Traders: Choose platforms with robust analytical features and ease of use.

- Long-Term Investors: Consider platforms that provide comprehensive research tools and economic analysis.

Evaluate Available Features

Identify which features are most important to you, such as:

- Customization options

- Automated trading capabilities

- Security features

- Access to educational resources

Check Broker Compatibility

Ensure that your chosen platform is compatible with the brokers you are considering. Some platforms may only work with specific brokers, which can affect your trading experience.

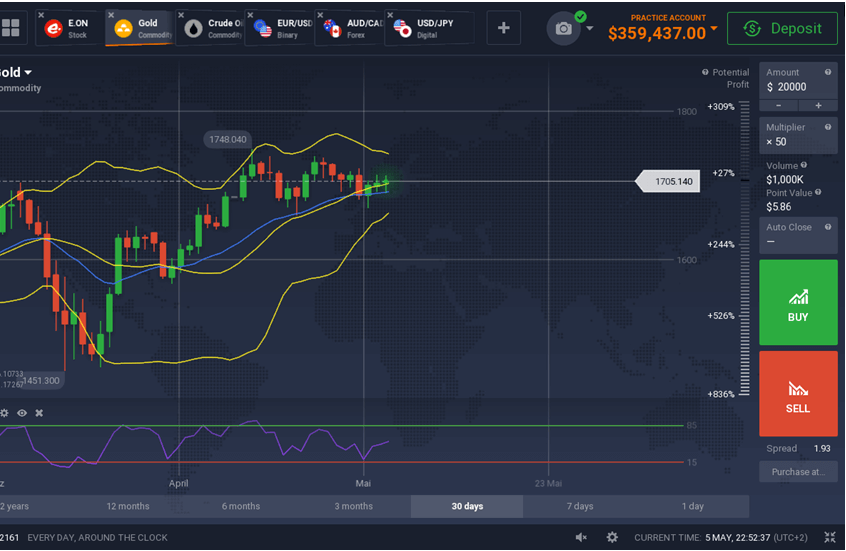

Test with a Demo Account

Most platforms offer demo accounts that allow you to test their features without risking real money. Use this opportunity to explore different platforms and find the one that suits you best.

Conclusion

Choosing the right forex trading platform is essential for your trading success. Each platform has its unique features, advantages, and disadvantages. By understanding these differences and assessing your trading style and needs, you can select a platform that enhances your trading experience.

For further information and to explore more about forex trading, consider visiting Investopedia, a valuable resource for traders of all levels.