Value Stocks vs. Growth Stocks continues to be a significant topic. Each type has unique characteristics that make it appealing to different types of investors. Whether you prioritize steady income or seek rapid capital growth, understanding the distinctions between value and growth stocks is essential for making informed investment decisions. This article provides an in-depth analysis of both, covering their definitions, characteristics, historical performance, and current market trends.

Table of Contents

ToggleDefinition of Value Stocks

Value stocks are stocks that trade at a price lower than their intrinsic value, often viewed as undervalued by the market. They are generally characterized by a low price-to-earnings (P/E) ratio, low price-to-book (P/B) ratio, and higher dividend yields. Investors are drawn to value stocks because they offer a balance of income and stability, making them ideal for long-term conservative investment strategies.

Characteristics of Value Stocks

- Undervalued: These stocks are seen as trading below their intrinsic value.

- Low P/E Ratio: Indicates that the stock is potentially undervalued relative to its earnings.

- High Dividend Yield: Value stocks often provide higher dividend payments, making them attractive to income-seeking investors.

- Low Volatility: Due to their focus on fundamentals, value stocks tend to be less volatile compared to growth stocks.

Examples of Value Stocks

- Banks: Established financial institutions often have solid fundamentals and pay dividends.

- Utilities: Utility companies are known for stability and high dividends.

- Consumer Staples: Companies that produce essential goods tend to have steady revenue and strong cash flows.

Definition of Growth Stocks

Growth stocks are companies with significant potential for revenue and earnings growth. These companies often reinvest profits back into the business rather than paying dividends, aiming for rapid expansion. Growth stocks typically have a high P/E ratio, high P/B ratio, and lower dividend yields.

Characteristics of Growth Stocks

- High Growth Potential: These stocks are expected to increase earnings at an above-average rate.

- High P/E Ratio: Reflects high investor expectations of future growth.

- Reinvestment of Profits: Growth companies often do not pay dividends, instead reinvesting in expansion.

- Greater Volatility: Growth stocks tend to be more volatile due to market expectations.

Examples of Growth Stocks

- Technology Companies: Firms in tech often demonstrate rapid growth and reinvest profits.

- Healthcare Companies: Innovative pharmaceutical and biotech firms are frequently categorized as growth stocks.

- Consumer Discretionary Companies: These companies often experience high growth during periods of economic expansion.

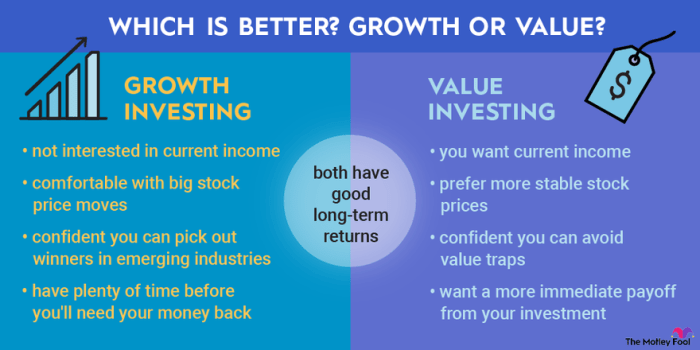

Key Differences Between Value and Growth Stocks

Understanding the distinctions between value stocks and growth stocks is crucial for developing a balanced investment portfolio. Here’s a detailed comparison:

| Characteristic | Value Stocks | Growth Stocks |

|---|---|---|

| P/E Ratio | Low | High |

| P/B Ratio | Low | High |

| Dividend Yield | High | Low |

| Growth Potential | Moderate | High |

| Volatility | Low | High |

| Market Sentiment | Conservative | Optimistic |

Value stocks tend to focus on fundamentals, stable earnings, and high dividends, whereas growth stocks target future expansion and reinvestment. Best dividend stocks often belong to the value category, providing a steady income stream alongside potential appreciation.

Historical Performance of Value vs. Growth Stocks

Historically, the debate of value vs. growth stocks has seen periods where one outperforms the other:

- Value Outperformance: Over the long term, value stocks have demonstrated superior performance due to their lower valuation and stable returns. They are particularly favored during periods of market uncertainty.

- Growth Dominance: Growth stocks, however, have surged in specific periods, especially when market conditions favor innovation and technology, like during the dot-com boom of the late 1990s.

Case Study: Technology Bubble of the Late 1990s

During the technology bubble of the late 1990s, growth stocks significantly outperformed value stocks, with tech companies like Amazon and Microsoft seeing explosive gains. However, the bubble burst in 2000, causing a massive downturn in growth stocks while value stocks remained relatively stable.

In recent years, growth stocks have continued to perform well, particularly in the tech sector, but rising interest rates and inflationary pressures have shifted focus back to value stocks. Currently, value stocks are seeing a resurgence, especially in sectors like energy, financials, and utilities.

Factors Influencing the Choice Between Value and Growth Stocks

1. Investor’s Risk Tolerance

Value stocks are generally less risky because they are based on stable fundamentals and are often less volatile. Conversely, growth stocks carry higher risks due to their emphasis on future earnings, which can lead to greater price swings.

2. Investor’s Time Horizon

The choice between value and growth stocks also depends on investment duration:

- Short-Term Investors may prefer growth stocks due to their potential for quick capital appreciation.

- Long-Term Investors often favor value stocks, which can offer steady returns over extended periods.

3. Market Conditions

Economic cycles heavily influence the performance of value and growth stocks. In uncertain or declining markets, value stocks tend to perform better. In contrast, growth stocks thrive in bull markets, where investor sentiment favors high-growth companies.

4. Stock Valuation

The decision between value and growth stocks often hinges on valuation metrics:

- P/E and P/B Ratios: Investors use these ratios to determine if a stock is undervalued (value stock) or if it’s expected to grow significantly (growth stock).

- Earnings Growth: For growth stocks, analysts often look at revenue and earnings projections to gauge potential.

Current Market Trends and Outlook: Value Stocks Vs. Growth Stocks

In 2024, the global economy faces mixed signals. Rising interest rates, inflation, and geopolitical tensions have led to a shift in investor sentiment. Presently, value stocks are outperforming growth stocks, reflecting caution among investors who are leaning towards stability.

Key Trends in 2024

- Interest Rate Hikes: Higher interest rates generally make growth stocks less attractive due to the increased cost of capital, leading investors to seek value opportunities.

- Inflation Concerns: Inflation tends to benefit value stocks, particularly in sectors like commodities and utilities, which can adjust prices accordingly.

- Sector Rotation: There’s a noticeable shift from high-tech, high-growth sectors to traditional value-oriented sectors like energy and healthcare.

While these trends favor value stocks, it’s essential to recognize that market dynamics are always changing. Past performance is not always indicative of future results, and diversifying your portfolio can help balance the risks.

Summary: Balancing Value and Growth in Your Portfolio

The choice between value and growth stocks depends on individual investment goals, risk tolerance, and market conditions. A well-balanced portfolio often includes both, allowing investors to take advantage of potential capital gains through growth stocks while securing stable returns from value stocks.

Key Takeaways

- Value stocks are ideal for conservative investors seeking stability and dividend income.

- Growth stocks offer the potential for high capital appreciation, suitable for investors with a higher risk tolerance.

- Top dividend stocks offer a unique opportunity to blend the benefits of value investing with growth potential.

- Regularly assess your portfolio to ensure it aligns with your financial goals, risk profile, and market conditions.

For a deeper understanding of how to harness the potential of dividend stocks within value investing, check out our comprehensive guide on How to Grow Wealth with Dividend Stocks.

FAQ Overview

What are the key differences between value and growth stocks?

Value stocks are typically undervalued compared to their intrinsic value, focusing on stability and dividends. Growth stocks, on the other hand, are priced at a premium due to their high growth potential, often reinvesting earnings rather than paying dividends.

Which type of stock is better for long-term investments?

Historically, value stocks have outperformed growth stocks over the long term due to their stable earnings and dividends. However, growth stocks have shown higher returns during periods of economic expansion.

How can I identify value and growth stocks?

Value stocks can be identified using metrics such as price-to-earnings (P/E) ratio and price-to-book (P/B) ratio, while growth stocks can be identified using metrics like price-to-sales (P/S) ratio and earnings per share (EPS) growth rate.

Investing is a long-term commitment, and the decision between value and growth stocks should be based on your personal financial goals, market outlook, and investment strategy.