Value investing – stands as one of the most revered strategies in the world of finance, offering investors a clear roadmap to uncover hidden opportunities in the stock market. Popularized by legendary investors like Benjamin Graham and Warren Buffett, this approach revolves around purchasing stocks that are trading below their intrinsic value, providing a margin of safety that minimizes the risk of loss. By focusing on the fundamentals of companies, value investors aim to capitalize on market inefficiencies, leveraging both patience and a disciplined approach to identify opportunities that others might overlook.

From the very beginning, value investing is more than just buying cheap stocks—it’s about recognizing the true worth of a company amidst the noise of daily price fluctuations and market sentiment. This long-term approach prioritizes businesses with solid financial health, competent management, and durable competitive advantages. By doing so, investors can accumulate wealth over time, navigating the ups and downs of the stock market with confidence.

Table of Contents

ToggleWhat Is Value Investing?

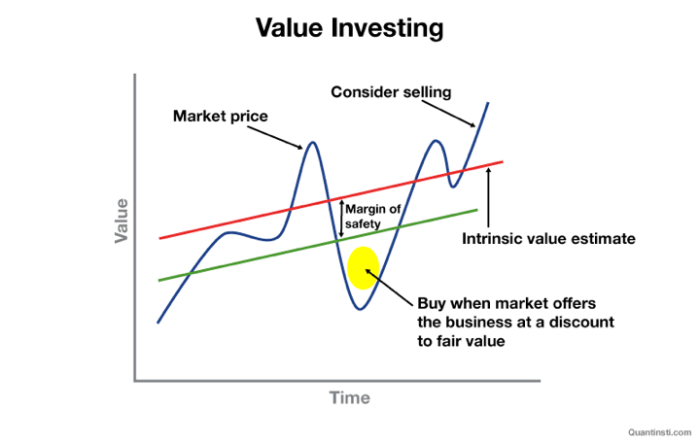

Value investing is a strategy that involves purchasing stocks that are priced lower than their intrinsic or true value. Intrinsic value refers to a company’s estimated worth, determined by its assets, earnings potential, and other fundamental factors.

Value investors believe that the stock market often overreacts to short-term events, causing stock prices to deviate from their intrinsic value. By purchasing undervalued stocks, these investors aim to profit as the market eventually corrects itself and prices reflect a company’s true worth.

Identifying Undervalued Stocks: Key Metrics and Ratios

To identify undervalued stocks, value investors rely on a set of financial ratios and analysis techniques that compare a company’s current stock price to its financial performance. These ratios provide insights into whether a stock is trading at a discount compared to its peers or the broader market.

Some of the most commonly used ratios in value investing include:

- Price-to-Earnings (P/E) Ratio: This ratio compares a company’s stock price to its earnings per share (EPS). A lower P/E ratio may indicate that the stock is undervalued relative to its earnings potential.

- Price-to-Book (P/B) Ratio: This metric compares the market value of a company’s stock to its book value (the value of its assets minus liabilities). A low P/B ratio can suggest that a stock is undervalued compared to its net assets.

- Price-to-Sales (P/S) Ratio: The P/S ratio compares a company’s stock price to its revenue. A low P/S ratio may indicate that a stock is undervalued relative to its sales performance.

- Debt-to-Equity Ratio: This ratio measures a company’s financial leverage by comparing its total debt to shareholder equity. A low debt-to-equity ratio signals financial stability and lower risk.

The Margin of Safety: Protecting Against Uncertainty

A key concept in value investing is the margin of safety, which refers to the difference between a stock’s intrinsic value and its current market price. This margin acts as a buffer that protects investors from downside risk, especially in uncertain or volatile markets.

To calculate the margin of safety, value investors often use two primary methods:

- Discounted Cash Flow (DCF) Analysis: This method estimates the present value of a company’s future cash flows, discounted back to the present at a specific rate. If the current market price is significantly lower than the calculated present value, there is a margin of safety.

- Earnings Multiples: Investors can also use earnings multiples, such as the P/E ratio, to estimate the intrinsic value of a stock. If a company’s earnings multiple suggests a higher intrinsic value than its current stock price, the stock may offer a margin of safety.

By building a portfolio of stocks with significant margins of safety, value investors can protect themselves against market downturns and unexpected events, ensuring that they do not overpay for a stock.

The Value Investing Process: Step-by-Step

The value investing process is structured and disciplined, with each step focused on minimizing risk and maximizing returns over the long term. Here’s a breakdown of how value investors typically approach this strategy:

- Identify Undervalued Stocks: Investors start by screening for stocks that appear undervalued based on financial ratios like P/E, P/B, and P/S. They also consider qualitative factors, such as management quality and industry trends.

- Calculate the Margin of Safety: Once a potentially undervalued stock is identified, investors calculate its intrinsic value using methods like DCF analysis or earnings multiples. They compare this intrinsic value to the stock’s current market price to determine the margin of safety.

- Conduct Due Diligence: Value investors perform in-depth research to verify the company’s financial health and competitive position. This step involves reviewing financial statements, assessing management’s track record, and analyzing industry conditions.

- Build a Diversified Portfolio: Value investors aim to construct a well-diversified portfolio of undervalued stocks. By investing across different industries and sectors, they reduce the risk associated with any single company or sector.

- Monitor the Portfolio: After investing, value investors continuously monitor their portfolio, staying updated on any changes to the companies they’ve invested in. They may adjust their holdings as new information emerges or as certain stocks approach their intrinsic value.

Famous Value Investors: Inspiration from the Masters

Several notable investors have achieved remarkable success using value investing principles. Here are some of the most prominent figures in the value investing world:

- Warren Buffett: Often referred to as the “Oracle of Omaha,” Warren Buffett is perhaps the most famous value investor in history. As the chairman of Berkshire Hathaway, Buffett has amassed a fortune by investing in undervalued companies with strong fundamentals and long-term growth potential.

- Benjamin Graham: Known as the father of value investing, Benjamin Graham authored the seminal book The Intelligent Investor, which outlines the principles of value investing and the importance of the margin of safety. Graham was also Warren Buffett’s mentor.

- David Einhorn: The founder of Greenlight Capital, Einhorn is a prominent value investor known for his contrarian views and his focus on finding stocks that are mispriced by the market.

- Seth Klarman: The author of Margin of Safety, Klarman is a highly respected value investor who emphasizes the importance of preserving capital and avoiding unnecessary risks.

Limitations of Value Investing

While value investing is a proven strategy, it is not without its challenges. One of the primary limitations is the risk of falling into value traps—stocks that appear undervalued based on traditional metrics but are actually suffering from fundamental problems that hinder their potential for recovery.

Additionally, value investing can be difficult in efficient markets where stock prices reflect all available information. In such markets, finding genuinely undervalued stocks becomes more challenging, as prices tend to align more closely with intrinsic value.

Combining Value Investing with Growth Strategies

While value investing focuses on undervalued stocks, some investors choose to diversify their portfolios by combining value and growth strategies. Growth investing, by contrast, targets companies with strong earnings growth potential, even if they are trading at higher valuations.

By blending these approaches, investors can achieve a balance between long-term value and the potential for capital appreciation, creating a more resilient portfolio that can perform well in a variety of market conditions.

Conclusion: The Enduring Appeal of Value Investing

In conclusion, value investing remains a powerful strategy for those who are patient, disciplined, and willing to do their homework. By focusing on stocks that are trading below their intrinsic value and insisting on a margin of safety, value investors can build portfolios that withstand market volatility and generate strong returns over the long term.

Whether you’re inspired by the success of Warren Buffett or drawn to the timeless wisdom of Benjamin Graham, embracing value investing principles can help you achieve your financial goals with confidence.