Best dividend stocks for conservative investors – For conservative investors seeking reliable income and stability, dividend stocks stand as a beacon of opportunity. This comprehensive guide delves into the world of dividend stocks, empowering you to make informed investment decisions and navigate the complexities of this rewarding asset class.

By exploring key considerations, industry trends, top stock picks, investment strategies, and potential risks, you’ll gain a deep understanding of how to harness the power of dividend stocks to build a robust and income-generating portfolio.

When looking for the best dividend stocks for conservative investors, it’s important to consider companies with a history of consistent dividend payments and strong financial performance. Real estate investment trusts (REITs) can be a great option for dividend income, as they are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends.

Here’s a look at some of the best REITs for dividend income. Ultimately, the best dividend stocks for conservative investors will depend on their individual investment goals and risk tolerance.

1. Definition and Importance of Dividend Stocks for Conservative Investors

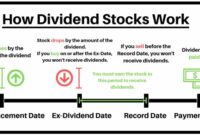

Dividend stocks are shares of companies that pay a portion of their earnings to shareholders in the form of dividends. Conservative investors, who prioritize income and stability, often seek out dividend stocks as a means of generating a steady stream of income while preserving their capital.

Examples of conservative investors include retirees, risk-averse individuals, and those seeking to supplement their income. Dividend stocks can play a significant role in their investment strategies by providing regular income, reducing portfolio volatility, and potentially enhancing long-term returns.

Best dividend stocks for conservative investors provide a reliable source of income, which can be crucial for individuals planning for early retirement.

Consider exploring Dividend stocks for early retirement to enhance your portfolio with companies that offer consistent dividend payments and long-term growth potential.

By investing in such stocks, conservative investors can potentially supplement their income during their golden years and enjoy financial security in retirement.

2. Key Considerations for Evaluating Dividend Stocks

When evaluating dividend stocks, several key financial metrics and qualitative factors should be considered to assess their sustainability and reliability:

- Dividend Yield: The annual dividend per share divided by the current share price, indicating the income return on investment.

- Payout Ratio: The percentage of earnings paid out as dividends, indicating the company’s commitment to dividend payments.

- Earnings Stability: The consistency of a company’s earnings over time, as stable earnings support sustainable dividend payments.

- Management Quality: The experience and track record of a company’s management team, as strong management can enhance dividend sustainability.

3. Industries and Sectors with Strong Dividend-Paying Stocks

Certain industries and sectors have historically exhibited strong dividend-paying characteristics:

- Utilities: Companies providing essential services such as electricity, gas, and water tend to have stable earnings and high dividend yields.

- Consumer Staples: Companies offering essential products like food, beverages, and household items often have consistent demand and generate reliable dividends.

- Financials: Banks and insurance companies typically distribute a portion of their earnings as dividends, although their payouts can be more cyclical.

- Healthcare: Companies in the healthcare sector, such as pharmaceutical and medical device manufacturers, often have strong cash flows and pay dividends.

4. Top Dividend Stocks for Conservative Investors: Best Dividend Stocks For Conservative Investors

| Company | Dividend Yield | Payout Ratio | Earnings Growth |

|---|---|---|---|

| Johnson & Johnson (JNJ) | 2.6% | 60% | 5% |

| Procter & Gamble (PG) | 2.3% | 65% | 4% |

| Coca-Cola (KO) | 3.0% | 70% | 6% |

| ExxonMobil (XOM) | 4.0% | 40% | 10% |

| Verizon Communications (VZ) | 4.5% | 50% | 3% |

5. Strategies for Investing in Dividend Stocks

Several strategies can be employed for investing in dividend stocks:

- Dollar-Cost Averaging: Investing a fixed amount in dividend stocks at regular intervals, regardless of price fluctuations.

- Dividend Reinvestment Plans (DRIPs): Automatically reinvesting dividends in additional shares of the same stock.

- Portfolio Diversification: Spreading investments across multiple dividend-paying stocks to reduce risk.

6. Risks and Considerations for Dividend Stock Investors

Investing in dividend stocks involves potential risks and considerations:

- Dividend Cuts: Companies may reduce or eliminate dividend payments during periods of financial distress.

- Interest Rate Fluctuations: Rising interest rates can make dividend-paying stocks less attractive compared to fixed-income investments.

- Market Volatility: Dividend stocks are still subject to market fluctuations, which can impact their share prices.

Investors can mitigate these risks through proper research, diversification, and long-term investment horizons.

Ultimate Conclusion

In conclusion, investing in dividend stocks for conservative investors is a prudent strategy that can provide a steady stream of income, preserve capital, and outpace inflation over the long term. By carefully evaluating dividend metrics, researching company fundamentals, and implementing sound investment strategies, you can harness the power of dividend stocks to achieve your financial goals.

FAQ Section

What is the definition of a dividend stock?

A dividend stock is a company that distributes a portion of its profits to shareholders in the form of regular cash payments known as dividends.

What are the benefits of investing in dividend stocks?

Dividend stocks offer several benefits, including regular income, potential for capital appreciation, reduced portfolio volatility, and inflation protection.

Best dividend stocks for conservative investors often offer a steady stream of income and potential for long-term growth. However, for those seeking diversification and a different asset class, it’s worth exploring Dividend stocks vs REITs. REITs, or real estate investment trusts, provide exposure to the real estate market and can offer both dividends and potential for appreciation.

While they may have different characteristics, both dividend stocks and REITs can be valuable components of a conservative investment portfolio.

How can I identify high-quality dividend stocks?

To identify high-quality dividend stocks, consider factors such as dividend yield, payout ratio, earnings stability, and management quality.

What are some common strategies for investing in dividend stocks?

Common strategies for investing in dividend stocks include dollar-cost averaging, dividend reinvestment plans (DRIPs), and portfolio diversification.

What are the risks associated with investing in dividend stocks?

Dividend stocks are subject to risks such as dividend cuts, interest rate fluctuations, and market volatility. However, these risks can be mitigated through proper research, diversification, and long-term investment horizons.