Revolutionizing Online Payments – In the fast-evolving world of digital finance, stablecoins are emerging as a revolutionary force for online payments. These digital assets, designed to maintain a stable value by being pegged to fiat currencies or other assets, offer a powerful combination of stability, security, and efficiency. For businesses and consumers alike, stablecoins provide a solution to many of the challenges associated with traditional cryptocurrencies and fiat currencies in online transactions. This guide explores how stablecoins are transforming online payments, the advantages they offer, the challenges they present, and their potential future in the global financial system.

Table of Contents

ToggleThe Rise of Stablecoins for Online Payments

Stablecoins are digital currencies that aim to provide price stability by being linked to a more stable reference, such as the US dollar, euro, or a basket of assets. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, which can experience extreme price volatility, stablecoins are designed to maintain a steady value, making them highly appealing for everyday transactions and online payments.

The ability of stablecoins to offer price predictability makes them an attractive alternative to traditional payment systems and even other cryptocurrencies. They bridge the gap between the innovation of blockchain technology and the stability of conventional fiat money, enabling smoother and more reliable financial interactions in the digital economy.

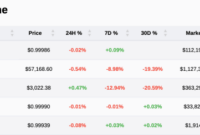

One of the most popular stablecoins, Tether (USDT), has gained significant traction in the world of online payments. Its daily trading volume and widespread use reflect the growing acceptance of stablecoins as a legitimate and efficient payment method. Other prominent stablecoins, such as USD Coin (USDC) and Binance USD (BUSD), are also making waves, providing businesses and consumers with a variety of options to suit their transaction needs.

Advantages of Using Stablecoins for Online Payments

The increasing adoption of stablecoins in the realm of online payments is driven by several key advantages they offer over traditional payment methods and more volatile cryptocurrencies.

1. Stability and Price Predictability

Perhaps the most significant advantage of stablecoins is their stability. Since stablecoins are typically pegged to fiat currencies like the US dollar or euro, they maintain a consistent value, avoiding the drastic fluctuations seen with other cryptocurrencies. This stability is essential for both businesses and consumers, as it ensures that the value of a transaction will remain consistent from the time it is initiated to when it is completed.

For example, in an online retail scenario, a business accepting Bitcoin as payment might face challenges if the price of Bitcoin suddenly drops before the transaction is settled. With stablecoins, this risk is minimized, making them a more reliable option for merchants and customers alike.

2. Reduced Volatility and Transaction Risks

The volatility associated with traditional cryptocurrencies like Bitcoin and Ethereum has been a major deterrent for their widespread use in everyday payments. Stablecoins address this issue by providing a steady value, reducing the risk of price swings during transactions. This stability not only benefits online merchants but also individuals who want to avoid the speculative risks associated with other digital currencies.

Moreover, the use of stablecoins can simplify online financial transactions, as users do not have to constantly monitor exchange rates or worry about losing value due to market fluctuations. This predictability is especially useful for international transactions, where currency exchange rates can create additional complexity and cost.

3. Streamlined International Payments

Cross-border payments can be costly and time-consuming due to currency conversions, fluctuating exchange rates, and intermediary fees. Stablecoins provide an efficient solution by enabling fast, low-cost, and transparent international transactions without the need for multiple intermediaries or currency exchanges.

For businesses operating in a global marketplace, stablecoins facilitate seamless international payments by allowing funds to move directly from sender to receiver in real-time. This eliminates the need for currency conversions and reduces the fees associated with traditional cross-border payment methods. Stablecoins also make it easier for companies to expand their global reach, as they can accept payments from customers around the world without worrying about currency fluctuations or excessive transaction fees.

Challenges and Considerations

While stablecoins offer numerous benefits for online payments, they also come with their own set of challenges and considerations. These challenges are important for both businesses and consumers to understand before fully integrating stablecoins into their payment systems.

1. Regulatory Concerns and Compliance Requirements

As stablecoins gain prominence, they are drawing increased attention from regulators around the world. Governments and regulatory bodies are still determining how best to regulate these digital assets, and in some cases, stablecoins are being classified as securities or money market instruments. This evolving regulatory landscape creates uncertainty for businesses looking to adopt stablecoins for online payments.

For example, in the United States, regulatory agencies are focusing on how stablecoins fit into existing financial regulations and whether they pose risks to financial stability. Companies using stablecoins must ensure they comply with these regulations to avoid legal issues, which can be complex and vary from one jurisdiction to another.

2. Transparency and Reserve Management

The stability of a stablecoin depends on the management of its reserves, as the value of the stablecoin is backed by these assets. For fiat-backed stablecoins, this means that the issuer must hold an equivalent amount of fiat currency or other assets in reserve to guarantee the value of the stablecoin.

Concerns have arisen around whether all stablecoin issuers maintain sufficient reserves to back the coins they issue. Transparency in reserve management is critical to maintaining trust in the stablecoin’s value. Businesses and consumers should ensure that they are using stablecoins from reputable issuers that provide clear and regular reports on their reserves.

3. Technological Integration and Security

Implementing stablecoins into existing payment systems requires businesses to ensure that the technology is secure and compatible with their current infrastructure. Integrating stablecoins into payment platforms can involve significant investment in technology and resources to ensure a smooth and secure transition.

Security is another major consideration. Like all digital assets, stablecoins are vulnerable to cyberattacks, hacking, and fraud. Businesses and individuals must take steps to protect their wallets and transactions through proper cybersecurity measures, such as two-factor authentication and encrypted communication.

Market Trends and Future Outlook

The adoption of stablecoins for online payments is expanding rapidly, driven by the growing acceptance of digital currencies and the desire for more efficient payment solutions. Data shows a sharp increase in the use of stablecoins for online transactions, and this trend is expected to continue as more businesses recognize their benefits.

Platforms like Ethereum have played a significant role in the rise of stablecoins, providing the infrastructure for decentralized applications and smart contracts that can facilitate automated and transparent payment processes. Ethereum’s blockchain technology allows for seamless integration of stablecoins into various financial services, from decentralized exchanges to peer-to-peer payment platforms.

Innovations in the stablecoin ecosystem, such as the development of algorithmic stablecoins and decentralized stablecoin platforms, are expected to further drive adoption. These innovations offer new ways to maintain stablecoin value without relying on traditional reserves, potentially making stablecoins more resilient and accessible.

Best Practices for Businesses Using Stablecoins

For businesses considering the adoption of stablecoins for online payments, several best practices should be followed to ensure successful integration and risk management.

1. Select a Reputable and Well-Established Stablecoin

When choosing a stablecoin for online payments, it’s important to select one with a strong track record, transparency in reserve management, and regulatory compliance. Stablecoins like USDC and BUSD have established themselves as trustworthy options backed by reputable organizations.

2. Secure Integration into Payment Systems

Businesses should ensure that their payment platforms are secure and compatible with stablecoins. Partnering with experienced payment processors or leveraging blockchain-based payment gateways can simplify this process.

3. Monitor Regulatory Developments

Since the regulatory landscape for stablecoins is still evolving, businesses must stay informed about changes in regulations and ensure they comply with any legal requirements in their region.

Case Studies: Successful Implementation of Stablecoins

Several companies have successfully integrated stablecoins into their payment systems, demonstrating the benefits of using these digital assets for online transactions.

For example, BitPay, a leading cryptocurrency payment processor, now supports stablecoins like USDC and BUSD, enabling merchants to accept payments in a stable and secure manner. This integration has allowed businesses to expand their global reach, reduce transaction costs, and provide customers with more flexible payment options.

Conclusion: Stablecoins Poised to Revolutionize Online Payments

As stablecoins gain wider adoption, they are poised to become a dominant force in the online payments landscape. Offering businesses and consumers a secure, efficient, and cost-effective way to transact, stablecoins provide stability and reliability in an increasingly digital economy.

The future of online payments will likely see greater integration of stablecoins, driven by advances in blockchain technology, regulatory clarity, and the growing demand for faster, more reliable payment solutions. By embracing stablecoins, businesses can enhance their payment systems, reduce costs, and navigate the complexities of global commerce with confidence.

Frequently Asked Questions (FAQs)

1. What are the benefits of using stablecoins for online payments?

Stablecoins provide stability and price predictability, reducing the risks associated with traditional cryptocurrencies. They also facilitate seamless international payments by eliminating the need for currency conversions and lowering transaction fees.

2. What are the challenges associated with using stablecoins?

The main challenges include regulatory uncertainty, transparency in reserve management, and the need for secure technological integration.

3. How can businesses implement stablecoins into their payment systems?

Businesses should select reputable stablecoins, integrate them securely into their payment systems, and stay informed about regulatory developments to ensure compliance and minimize risks.