Daily Trading Volume – Tether (USDT) is one of the most crucial stablecoins in the cryptocurrency ecosystem, designed to maintain a stable value by being pegged to fiat currencies like the US dollar. Among the factors that highlight its importance is its daily trading volume, which provides insights into market liquidity, investor behavior, and the broader stability of the cryptocurrency market. Understanding the dynamics of Tether’s daily trading volume helps investors and traders navigate the complexities of the cryptocurrency space, offering a lens into how market participants are responding to price movements, volatility, and emerging trends.

This article delves into the significance of Tether’s trading volume, examining the factors that influence its fluctuations, its role in cryptocurrency markets, and the wider impact on digital assets.

Table of Contents

ToggleTether Trading Volume Overview

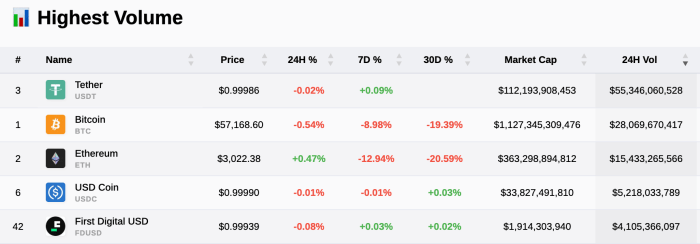

Tether’s daily trading volume has consistently outpaced many other cryptocurrencies, including Bitcoin. This is because Tether acts as a safe haven during periods of extreme volatility in the cryptocurrency market. Investors and traders frequently use stablecoins like Tether to protect their funds when the value of volatile digital assets like Bitcoin or Ethereum fluctuates significantly.

Historically, Tether’s trading volume has seen substantial growth, particularly during times of heightened market activity. During major market events, such as Bitcoin bull runs or sudden price corrections, Tether’s volume surges as traders exchange their volatile cryptocurrencies for stablecoins to mitigate risks.

The massive trading volume of Tether speaks to its role as the go-to stablecoin for liquidity, providing investors with a buffer against the rapid swings in the market.

Tether’s dominant position in the stablecoin market is clear, as it surpasses many cryptocurrencies in terms of usage. However, the cryptocurrency landscape is evolving rapidly, with advancements in blockchain technology, such as Polkadot’s scalability solutions (e.g., sharding and parachains), having the potential to enhance the overall market efficiency. As blockchain scalability improves, Tether’s trading volume might see further growth, as more users enter the space and benefit from faster, more cost-effective transactions.

Factors Influencing Tether’s Trading Volume

Tether’s daily trading volume does not remain static. Instead, it is influenced by a combination of market, regulatory, and technological factors. Below are some of the key drivers behind the fluctuations in Tether’s trading volume:

- Market Volatility

Volatility in the cryptocurrency market often causes a spike in Tether’s trading volume. During periods of high volatility, investors tend to flock to stablecoins like Tether to protect their holdings. For example, during a Bitcoin price crash, investors may convert their Bitcoin to Tether to avoid further losses. This makes Tether a critical asset in helping traders navigate uncertain markets.

- Demand for Stablecoins

As one of the earliest stablecoins, Tether has enjoyed widespread adoption across cryptocurrency exchanges. It is widely used as a trading pair for other cryptocurrencies, facilitating seamless conversions between volatile assets and a stable medium of exchange. This demand for Tether in trading pairs is a significant factor in its high daily trading volume.

- Regulatory Landscape

Regulatory developments also have a strong influence on Tether’s trading volume. When regulatory agencies announce new measures or restrictions on cryptocurrency activities, trading volumes across the market can increase as traders reposition their portfolios. Moreover, scrutiny regarding Tether’s reserves and its ability to maintain its peg to the US dollar has triggered periods of heightened trading activity, as investors look for signs of stability.

- Market Sentiment

General market sentiment plays a role in Tether’s trading activity. During periods of optimism, traders may move from Tether into more speculative assets, reducing its volume. Conversely, in times of fear, there is an increase in demand for stable assets, resulting in a surge in Tether’s volume.

Comparison with Other Stablecoins

Tether holds a dominant position in the stablecoin market, particularly in terms of trading volume. Although several other stablecoins, such as USD Coin (USDC) and Binance USD (BUSD), have gained traction in recent years, Tether still leads in daily trading volume. This dominance is attributed to several factors:

- Early Market Entry: Tether was one of the first stablecoins introduced to the cryptocurrency market. Its early entry has allowed it to build a substantial user base and liquidity across multiple exchanges.

- Widespread Adoption: Tether is listed on nearly every major cryptocurrency exchange and is frequently used in trading pairs, giving it a significant liquidity advantage.

- Liquidity: Tether’s liquidity across global exchanges makes it the preferred choice for traders looking for fast conversions between cryptocurrencies and stable assets.

Despite this, Tether faces increasing competition from other stablecoins, particularly USDC, which has gained favor due to its transparency and regulatory compliance. As newer stablecoins offer added features like staking rewards or integration with decentralized finance (DeFi) protocols, they are slowly eroding Tether’s dominance.

Impact of Tether’s Trading Volume on the Cryptocurrency Market

Tether’s role in the cryptocurrency market extends beyond its use as a stable medium for trading. Its daily trading volume has broader implications for the health and liquidity of the entire cryptocurrency ecosystem:

- Market Liquidity

Tether’s high trading volume provides essential liquidity to the cryptocurrency market. It ensures that traders can move large amounts of capital quickly and efficiently without causing significant price movements. This liquidity reduces price volatility across markets, helping stabilize trading conditions even during periods of high demand.

- Influence on Cryptocurrency Prices

Tether is often used as an intermediary asset when traders enter or exit positions in other cryptocurrencies. As a result, fluctuations in Tether’s volume can indirectly impact the price of other cryptocurrencies. When there is a rush into Tether, it can signal a risk-off environment where traders are moving away from speculative assets, putting downward pressure on cryptocurrency prices.

Regulatory Considerations

Regulatory scrutiny of Tether has been a recurring theme, particularly due to questions surrounding its reserves and whether it is fully backed by US dollars or other assets. Such scrutiny has led to periodic surges in trading volume as investors react to potential regulatory risks.

For instance, announcements of investigations into Tether’s operations have historically triggered spikes in trading volume as traders either exit their Tether holdings or hedge against possible instability.

Regulatory developments concerning stablecoins at large, especially in major markets like the U.S. and the European Union, are likely to have an impact on Tether’s volume. Any regulations mandating greater transparency or reserve audits could influence investor confidence in Tether, which would directly affect its trading volume.

Fluctuations in Tether’s Trading Volume: Implications and Outlook

Significant fluctuations in Tether’s daily trading volume can have various implications for the broader cryptocurrency market:

- Market Stability: Large swings in Tether’s volume often correlate with major price movements in cryptocurrencies. A significant increase in volume can signal heightened uncertainty or risk, while a drop in volume may indicate investor confidence and a lower demand for stable assets.

- Reserve Transparency: As regulatory scrutiny continues, fluctuations in Tether’s trading volume may reflect investor sentiment around its reserves. Should confidence in Tether’s backing wane, it could lead to a shift toward other stablecoins.

Conclusion

Tether’s daily trading volume serves as a critical barometer for the overall health of the cryptocurrency market. It reflects market liquidity, investor sentiment, and reactions to regulatory developments. As one of the most traded assets in the digital currency space, understanding the dynamics behind Tether’s trading volume is essential for both traders and analysts.

While Tether remains dominant in terms of trading volume, emerging competitors and new blockchain technologies could shape its future role. In a rapidly evolving market, Tether’s volume will continue to offer valuable insights into the state of the cryptocurrency ecosystem, providing a pulse on market activity, investor sentiment, and overall stability.

Frequently Asked Questions (FAQ)

What factors influence Tether’s daily trading volume?

- Market volatility, demand for stablecoins, regulatory developments, and overall market sentiment are the primary drivers behind Tether’s daily trading volume.

How does Tether’s volume compare to other stablecoins?

- Tether consistently ranks at the top in terms of daily trading volume, outpacing other stablecoins like USDC and BUSD due to its early establishment and widespread adoption.

What are the implications of fluctuations in Tether’s trading volume?

- Fluctuations in Tether’s trading volume can signal changes in market sentiment, impact the liquidity of the cryptocurrency market, and influence the price of other digital assets.