Forex Market Trends – The foreign exchange (Forex) market is a dynamic and complex arena where currencies from across the globe are bought and sold. It is the largest and most liquid financial market, with an average daily trading volume of over $6 trillion. Forex market trends provide valuable insights into the direction of currency price movements and are crucial for successful trading and investment strategies. Understanding these trends, and the factors influencing them, enables traders to make informed decisions, manage risks, and capitalize on market opportunities. In this comprehensive guide, we will explore the various aspects of Forex market trends, including technical and fundamental analysis, the role of market sentiment, and the use of price action strategies for trend identification.

What Are Forex Market Trends?

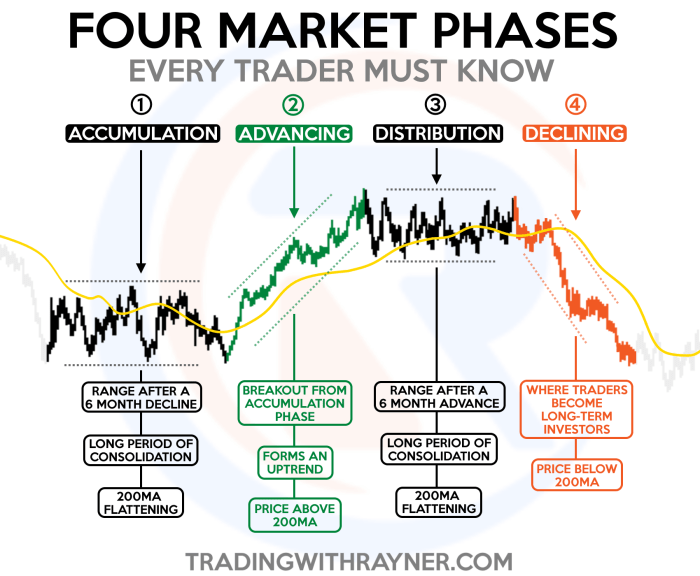

A trend in the Forex market refers to the general direction in which a currency pair is moving over a given period of time. Trends can be upward (bullish), downward (bearish), or sideways (ranging). By identifying the prevailing trend, traders can align their strategies to either follow the trend or anticipate potential reversals.

Types of Forex Market Trends:

- Uptrend (Bullish Market): This occurs when the price of a currency pair consistently moves higher over time. In an uptrend, traders typically look for opportunities to buy the currency pair, expecting the price to continue rising.

- Downtrend (Bearish Market): A downtrend is when the price of a currency pair consistently declines. Traders in a bearish market often seek to sell or short the currency pair, betting that the price will continue falling.

- Sideways or Range-Bound Market: In this type of market, the price fluctuates within a defined range without showing a clear upward or downward direction. Traders often employ range-bound strategies, buying at the lower end of the range and selling at the higher end.

Key Factors Influencing Forex Market Trends

Several factors influence currency price movements in the Forex market. These can be broadly categorized into economic, political, and global factors. By understanding the underlying drivers of trends, traders can better anticipate market movements and adjust their strategies accordingly.

1 Economic Indicators

Economic data releases are among the most significant drivers of Forex market trends. Key economic indicators include:

- Gross Domestic Product (GDP): GDP measures the total economic output of a country. A growing GDP typically strengthens the national currency, as it indicates a healthy economy. Conversely, a declining GDP may weaken the currency.

- Inflation Rates: Central banks monitor inflation closely and may raise interest rates to combat rising inflation. Higher interest rates make a currency more attractive to investors, leading to appreciation. Low inflation or deflation can have the opposite effect.

- Employment Data: The level of employment, including the unemployment rate and job creation figures, provides insights into the health of an economy. Strong employment data can lead to currency appreciation, while weak data can result in depreciation.

- Interest Rates: Central banks, such as the Federal Reserve in the United States or the European Central Bank, set interest rates to control monetary policy. Higher interest rates generally attract foreign investment, increasing demand for the currency and pushing its value higher. Conversely, lower interest rates tend to weaken the currency.

2 Political Factors

Political events and instability can have a profound impact on Forex market trends. Traders must stay informed about geopolitical developments, as they can create volatility and uncertainty in the markets.

- Elections and Government Policies: Political elections and the resulting policies of a new government can influence a country’s economic prospects. A stable political environment often leads to currency appreciation, while political uncertainty can weaken the currency.

- Trade Agreements and Sanctions: International trade deals or sanctions can affect the flow of goods and services between countries, impacting currency values. A favorable trade agreement can boost a country’s economy, strengthening its currency, while sanctions can have the opposite effect.

- Geopolitical Tensions: Wars, conflicts, and other geopolitical tensions create risk aversion in the market, often leading to safe-haven flows. Currencies like the US dollar, Swiss franc, and Japanese yen may appreciate during periods of global uncertainty, as investors seek stability.

3 Global Events and Natural Disasters

Global events, such as pandemics, natural disasters, or significant technological breakthroughs, can also influence Forex market trends. For instance, the COVID-19 pandemic led to unprecedented market volatility, with currencies fluctuating in response to lockdowns, government stimulus packages, and changing investor sentiment.

Technical Analysis in Forex Trading

Technical analysis is a widely used method for identifying Forex market trends. It involves analyzing historical price data and trading volume to predict future price movements. Technical analysts use various tools and indicators to detect patterns and trends in price charts.

1 Price Charts and Patterns

Price charts are the foundation of technical analysis. Traders use different types of charts, such as line charts, bar charts, and candlestick charts, to visualize price movements.

- Candlestick Patterns: Candlestick patterns, such as Doji, engulfing, and hammer patterns, provide clues about potential trend reversals or continuations. For example, a bullish engulfing pattern may signal the start of an uptrend, while a Doji may indicate market indecision and a possible trend reversal.

- Support and Resistance Levels: Support is the price level at which demand for a currency pair is strong enough to prevent the price from falling further, while resistance is the level where selling pressure prevents the price from rising. Identifying these levels helps traders make informed decisions about entry and exit points.

2 Moving Averages

Moving averages are popular technical indicators used to smooth out price data and identify trends. There are two main types of moving averages:

- Simple Moving Average (SMA): This is calculated by averaging the closing prices over a specified period. For example, a 50-day SMA calculates the average closing price over the last 50 days. When the price is above the SMA, it indicates an uptrend, while a price below the SMA suggests a downtrend.

- Exponential Moving Average (EMA): The EMA gives more weight to recent prices, making it more responsive to current market conditions. The 50-day and 200-day EMAs are commonly used by traders to confirm trends.

3 RSI and MACD Indicators

- Relative Strength Index (RSI): The RSI is a momentum indicator that measures the speed and change of price movements. It ranges from 0 to 100, with levels above 70 indicating overbought conditions and levels below 30 signaling oversold conditions. Traders use the RSI to identify potential trend reversals.

- Moving Average Convergence Divergence (MACD): The MACD is a trend-following indicator that shows the relationship between two moving averages (typically the 12-day and 26-day EMAs). When the MACD line crosses above the signal line, it generates a bullish signal, while a bearish signal occurs when the MACD line crosses below the signal line.

Fundamental Analysis in Forex Trading

Fundamental analysis focuses on the underlying economic, political, and financial factors that influence currency prices. Unlike technical analysis, which looks at past price movements, fundamental analysis examines the intrinsic value of a currency based on macroeconomic conditions.

1 Economic Reports

Key economic reports, such as inflation, employment data, and GDP growth, provide insights into a country’s economic health. Central banks also play a critical role in influencing currency prices through their monetary policy decisions.

- Central Bank Decisions: Central banks, such as the Federal Reserve or the European Central Bank, set interest rates to control inflation and stimulate economic growth. Higher interest rates generally strengthen a currency, while lower rates weaken it.

2 Geopolitical and Global Factors

Political stability, government policies, and international relations all contribute to the fundamental analysis of currency trends. A country facing political unrest or sanctions may see its currency depreciate, while a stable and economically robust country may experience currency appreciation.

Trading Without Indicators: Price Action Strategy

While many traders rely on technical indicators to identify trends, others prefer a more straightforward approach by trading without indicators. This is known as price action trading, which focuses on analyzing raw price movements without the aid of additional tools.

1 Support and Resistance in Price Action

Price action traders pay close attention to key support and resistance levels, which act as barriers to price movements. By observing how prices react at these levels, traders can make informed decisions about whether to buy, sell, or hold their positions.

2 Trendlines and Channels

Trendlines are drawn by connecting successive highs or lows in a price chart. A rising trendline indicates an uptrend, while a declining trendline suggests a downtrend. Channels are formed when price movements stay within parallel trendlines, indicating a strong trend with defined support and resistance levels.

Risk Management and Trading Psychology

Understanding Forex market trends is essential, but equally important is managing the risks associated with trading. Effective risk management strategies, such as setting stop-loss orders and determining appropriate position sizes, can help traders protect their capital and minimize losses.

1 Setting Stop-Loss and Take-Profit Levels

A stop-loss order limits the potential loss on a trade by automatically closing the position when the price reaches a predetermined level. Take-profit orders, on the other hand, lock in profits when the price hits a target level.

2 Managing Emotions

Trading psychology plays a significant role in Forex market success. Traders must maintain discipline and avoid emotional decision-making, which can lead to impulsive trades and unnecessary losses. Developing a solid trading plan and sticking to it is key to maintaining emotional balance in the volatile Forex market.

Conclusion

Understanding Forex market trends is vital for traders seeking to navigate the complex world of currency trading. By combining technical and fundamental analysis, traders can gain valuable insights into market movements and make informed decisions. Whether relying on technical indicators or price action strategies, successful Forex trading requires continuous learning, disciplined risk management, and a keen awareness of global economic and political developments. With the right approach, traders can harness the power of Forex market trends to achieve financial success in this dynamic market