Forex breakout entries offer a lucrative opportunity for traders to capitalize on market momentum and maximize profits. By understanding the concept, identifying breakout opportunities, and implementing effective entry strategies, traders can harness the power of breakouts to enhance their trading performance.

Mastering Forex breakout entries requires a blend of technical analysis and psychological resilience. Forex trading psychology plays a crucial role in navigating the emotional rollercoaster of breakout trades, helping traders manage risk, maintain discipline, and avoid costly mistakes.

By understanding the psychological factors that influence trading decisions, traders can develop a robust mindset that supports successful breakout entries and overall trading performance.

Delve into the intricacies of breakout trading, explore proven entry strategies, and discover risk management techniques to navigate market volatility and secure consistent gains.

Forex Breakout Entries

Forex breakout entries are a type of trading strategy that involves entering a trade when the price of a currency pair breaks out of a defined range or level. This strategy is based on the assumption that a breakout indicates a change in the trend of the market, and that traders can profit from this change by entering a trade in the direction of the breakout.

Forex breakout entries can be identified using various technical indicators, including the MACD forex strategy. This strategy combines the Moving Average Convergence Divergence (MACD) indicator with other technical analysis tools to identify potential breakout points.

By analyzing the MACD’s histogram and signal lines, traders can gauge market momentum and identify potential breakout opportunities, which can be further confirmed by other indicators and price action analysis.

Types of Breakout Entries

There are several different types of breakout entries, including:

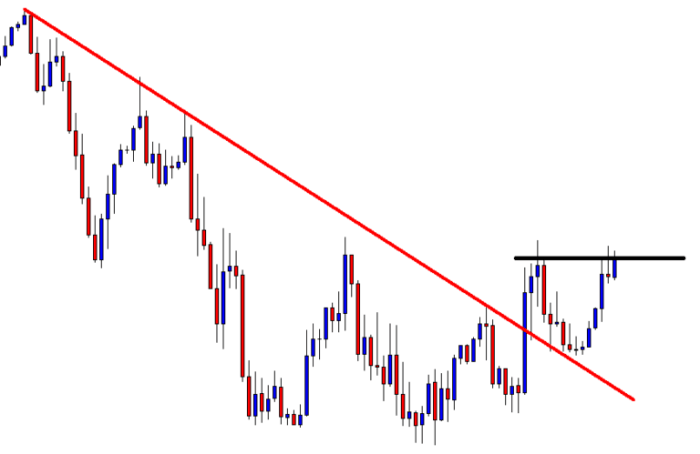

- Trendline breakouts: These occur when the price of a currency pair breaks out of a trendline that has been established by connecting a series of highs or lows.

- Support and resistance breakouts: These occur when the price of a currency pair breaks out of a support or resistance level. Support levels are areas where the price has previously found buyers, while resistance levels are areas where the price has previously found sellers.

- Candlestick breakouts: These occur when the price of a currency pair breaks out of a candlestick pattern, such as a bullish engulfing pattern or a bearish engulfing pattern.

Advantages and Disadvantages of Breakout Entries, Forex breakout entries

There are several advantages to using breakout entries in trading, including:

- They can provide a clear and objective entry point.

- They can be used to trade in both trending and ranging markets.

- They can be used to identify high-probability trading opportunities.

However, there are also some disadvantages to using breakout entries in trading, including:

- They can be subject to false breakouts.

- They can be difficult to identify in real time.

- They can require a high level of risk tolerance.

Closing Notes: Forex Breakout Entries

Mastering forex breakout entries empowers traders with a robust trading strategy that combines technical analysis, risk management, and a deep understanding of market dynamics.

By incorporating these principles into their trading approach, traders can unlock the full potential of breakout trading and achieve sustained profitability in the forex market.

Essential FAQs

What are the advantages of using breakout entries in forex trading?

Breakout entries provide traders with the potential for high-reward trades, as they offer an opportunity to capture significant market moves. Additionally, breakouts can provide clear entry and exit points, making it easier for traders to manage their risk and maximize profits.

Forex breakout entries, a key element of successful trading, require careful identification of optimal entry points. For comprehensive guidance on entry point strategies, refer to our article on Forex entry points.

By understanding the nuances of different entry techniques, traders can enhance their ability to capitalize on breakout opportunities and navigate the complexities of the Forex market.

How can I identify potential breakout opportunities in the forex market?

Traders can use technical analysis tools such as moving averages, Bollinger Bands, and Fibonacci levels to identify potential breakout opportunities. By studying price action and market trends, traders can increase their chances of identifying high-probability breakout setups.

What are some common mistakes to avoid when trading breakout entries?

Common mistakes to avoid include trading false breakouts, overleveraging, and failing to manage risk effectively. False breakouts can lead to significant losses, while overleveraging can expose traders to unnecessary risk. Proper risk management is crucial to protect capital and ensure long-term trading success.