value stocks with dividends offers a unique opportunity for both capital appreciation and a steady stream of income. By focusing on companies that are undervalued and pay dividends, investors can achieve long-term wealth creation while mitigating risks. In this guide, we’ll explore the benefits of value stocks with dividends, how to identify them, and strategies to build a diversified portfolio.

Table of Contents

ToggleOverview of Value Stocks with Dividends

Value stocks are typically shares of companies trading at a lower price than their intrinsic value. These stocks tend to have strong fundamentals, including low debt, consistent earnings, and high profit margins. Adding dividends into the mix makes value stocks even more attractive, as companies pay out a portion of their profits to shareholders in the form of regular payments, offering an additional source of income.

Dividends can serve as a reliable income stream, particularly for retirees or investors looking to supplement other income sources. At the same time, the price of the value stock itself has the potential to appreciate over the long term, providing a two-fold advantage of income generation and capital gains.

Benefits of Investing in Value Stocks with Dividends

Investing in value stocks with dividends offers a range of benefits that make them an appealing choice for both income-seeking and growth-oriented investors:

1. Steady Income Stream

Dividends provide regular payments to shareholders, which can be reinvested or used as a source of income. For long-term investors, dividends serve as a way to generate passive income, making them especially useful for retirement planning.

2. Potential for Capital Appreciation

Though value stocks are typically undervalued, there is significant potential for capital appreciation over time. As the market recognizes the company’s intrinsic value, its stock price may rise, rewarding patient investors.

3. Stability in Volatile Markets

Value stocks are often considered less volatile than growth stocks. Because they are already undervalued, they provide a margin of safety in turbulent markets. The presence of dividends adds to this stability, providing income even when stock prices are stagnant.

4. Long-Term Outperformance

Historically, value stocks with dividends have outperformed growth stocks over extended periods. According to research, dividend-paying stocks have shown consistent returns, especially in bear markets or during economic downturns.

Identifying Value Stocks with Dividends

Not all value stocks offer dividends, and not all dividend-paying stocks are considered value stocks. To find the right combination, there are several key metrics and criteria investors should evaluate:

1. Low Price-to-Earnings (P/E) Ratio

A low P/E ratio suggests that a company’s stock is undervalued compared to its earnings. Companies with lower P/E ratios are generally more attractive to value investors, especially when paired with stable earnings and cash flow.

2. High Dividend Yield

The dividend yield is calculated by dividing the annual dividend payment by the stock’s current price. A higher yield may indicate a better return on investment, but investors should be cautious, as an unusually high yield could suggest the company is struggling to maintain its dividend.

3. Strong Balance Sheet

Companies with low debt and strong cash reserves are better positioned to continue paying dividends even in challenging economic conditions. A solid balance sheet is essential for both value and dividend sustainability.

4. Consistent Earnings Growth

Companies with a history of stable earnings and dividend growth are generally better candidates for long-term investment. Growth in earnings often translates to growing dividends, providing investors with increasing income over time.

Building a Portfolio of Value Stocks with Dividends

Constructing a well-diversified portfolio of value stocks with dividends requires careful planning. A balanced approach helps reduce risks while optimizing for both income and growth. Here are the key steps to building such a portfolio:

1. Diversify Across Sectors

Diversification across different industries and sectors is essential for mitigating risk. For example, combining dividend-paying stocks from sectors like technology, healthcare, consumer staples, and utilities can provide stability and reduce the impact of sector-specific downturns.

2. Focus on Dividend Consistency

Choose companies with a long history of paying and increasing dividends. These “dividend aristocrats” or “dividend champions” are typically large, well-established firms with a track record of reliable payouts.

3. Regular Monitoring and Rebalancing

It’s important to monitor the performance of your portfolio and rebalance it as necessary. If one sector becomes overrepresented or a company’s fundamentals deteriorate, adjusting your holdings can help maintain portfolio health.

4. Consider Dividend Reinvestment

For investors seeking to compound their returns, reinvesting dividends can accelerate growth. Dividend reinvestment plans (DRIPs) allow you to automatically reinvest dividends back into more shares of the stock, boosting your overall investment.

Considerations for Investors

While value stocks with dividends provide a range of benefits, there are some risks and considerations to keep in mind before investing:

1. Dividend Cuts

A company’s ability to pay dividends is tied to its profitability. If a company experiences financial difficulties, it may reduce or eliminate its dividend, leading to a drop in income for investors.

2. Underperformance During Growth Markets

In bullish market conditions, growth stocks often outperform value stocks. Investors in value stocks may experience periods of underperformance when the market favors growth or speculative investments.

3. Interest Rates and Economic Conditions

Dividend-paying stocks can be sensitive to interest rate fluctuations. When rates rise, bonds and other fixed-income securities may become more attractive to income-seeking investors, potentially drawing capital away from dividend stocks.

Why Value Stocks Are a Valuable Addition to Your Portfolio

Value stocks typically trade at a discount relative to their intrinsic value, offering both growth potential and capital appreciation. Their attractiveness is further enhanced when these companies pay dividends, as they provide income while waiting for the stock price to appreciate. For long-term investors seeking financial stability, value stocks with dividends offer a balanced approach to wealth creation.

Adding value stocks with dividends to your portfolio can enhance diversification, provide a hedge against market volatility, and ensure that you have a steady income stream. This combination of income generation and long-term growth makes them a vital component of any well-rounded investment strategy.

Ultimate Conclusion

Investing in value stocks with dividends presents a compelling opportunity for achieving financial goals, whether they involve generating income, building wealth, or weathering market volatility. By carefully selecting undervalued companies with strong dividend-paying histories and diversifying across sectors, you can create a portfolio that balances risk and return. Regular monitoring and rebalancing, combined with a long-term investment horizon, will help you navigate market fluctuations and position yourself for sustained success.

Detailed FAQs: Value Stocks with Dividends

1. What are value stocks?

Value stocks are shares of companies that are undervalued compared to their intrinsic value, typically identified using metrics like a low P/E ratio or high book value.

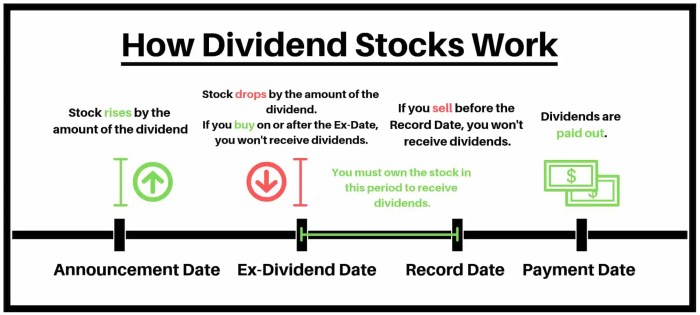

2. What are dividends?

Dividends are payments made by companies to their shareholders, usually from profits, on a regular basis, such as quarterly or annually.

3. What is the relationship between value stocks and dividends?

Value stocks often pay dividends because they are mature companies with stable earnings. These stocks provide both capital appreciation potential and a steady income stream through dividend payments.

For more insights on how to build a diversified portfolio of value stocks with dividends, visit Morningstar’s Dividend Guide.