Value Stocks vs ETFs – Investing in the stock market is a great way to grow your wealth over time, but deciding where to invest your money can be challenging. Two common investment choices are value stocks and exchange-traded funds (ETFs), each with distinct characteristics, benefits, and risks. In this guide, we’ll delve into the differences between these investment options, covering aspects such as risks, returns, strategies, and trends, to help you make informed financial decisions.

Both value stocks and ETFs can play a crucial role in your portfolio, depending on your investment goals, risk tolerance, and time horizon. Whether you’re seeking long-term growth, income, or diversification, understanding these options will help you create a well-rounded strategy.

Table of Contents

ToggleWhat Are Value Stocks?

Value stocks refer to shares of companies that are considered undervalued compared to their intrinsic value. Investors typically look for companies with strong fundamentals, such as consistent earnings, healthy cash flow, and low debt, that are trading at a price below their book value. This strategy focuses on finding “hidden gems” in the market—companies that the broader market might be undervaluing due to temporary setbacks or market inefficiencies.

Value stocks are generally less volatile than growth stocks and tend to outperform during periods of economic downturn. They provide a margin of safety for investors, as their low valuations protect against severe market fluctuations. Additionally, they often pay dividends, making them attractive for income-seeking investors.

Key Characteristics of Value Stocks:

- Undervalued: Trade at lower prices compared to their intrinsic value.

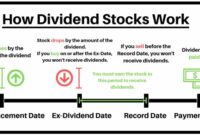

- Dividends: Often offer steady dividend payments.

- Margin of Safety: Less risky due to their lower valuations.

- Long-Term Focus: Best suited for long-term investors looking for stability.

What Are ETFs?

An exchange-traded fund (ETF) is a basket of securities, such as stocks, bonds, or commodities, that tracks an underlying index or sector. ETFs offer investors instant diversification by holding multiple assets in a single fund. They are traded on stock exchanges, just like individual stocks, making them highly liquid and accessible to retail investors.

ETFs are popular due to their low cost and ability to provide broad market exposure. They allow investors to invest in entire sectors, themes, or indices without having to pick individual stocks. For example, you can invest in an ETF that tracks the S&P 500, giving you exposure to 500 of the largest companies in the U.S., or one that focuses on emerging markets, clean energy, or artificial intelligence.

Key Characteristics of ETFs:

- Diversification: Hold a variety of securities, reducing the risk of single-stock exposure.

- Liquidity: Traded on exchanges like individual stocks.

- Lower Costs: Typically have lower expense ratios compared to mutual funds.

- Broad Exposure: Track indices, sectors, or investment themes.

Risk and Return: Value Stocks vs ETFs

When comparing the risk and return profiles of value stocks and ETFs, it’s essential to understand that both have distinct advantages.

Value Stocks:

- Risk: Value stocks tend to be less risky compared to high-growth stocks because they invest in companies with strong fundamentals and a history of stable earnings. Their low valuations often provide a cushion against downturns.

- Return: Historically, value stocks have outperformed growth stocks over extended periods. However, the returns may be lower in the short term due to market fluctuations.

ETFs:

- Risk: ETFs are typically less risky than individual stocks because of their diversification. An ETF tracking a broad index like the S&P 500 spreads the risk across multiple sectors and companies.

- Return: ETFs that focus on high-growth sectors or themes, such as technology or clean energy, have delivered significant returns in recent years. However, their performance is closely tied to market conditions and specific sectors’ performance.

It’s important to note that both value stocks and ETFs can be subject to market volatility, and their returns depend on broader economic trends and company performance.

Investment Strategies: Value Stocks vs ETFs

When it comes to investment strategies, value stocks and ETFs cater to different types of investors with varying objectives.

Value Stock Investment Strategies:

- Deep Value: Investors look for companies trading at a significant discount to their intrinsic value, often because the market has overlooked them. These companies may be in industries that are out of favor or facing temporary challenges.

- Growth at a Reasonable Price (GARP): This strategy focuses on companies with strong growth potential but at a fair or reasonable price. GARP investors aim to balance growth and value by selecting companies that offer a mix of both.

ETF Investment Strategies:

- Index Tracking: ETFs that track a broad index, like the S&P 500 or NASDAQ, provide exposure to a large number of companies and offer market-like returns.

- Sector-Specific: These ETFs focus on specific sectors, such as healthcare, technology, or energy, allowing investors to target industries they believe will outperform the broader market.

- Thematic Investing: Thematic ETFs focus on trends, such as sustainability, AI, or electric vehicles. This allows investors to gain exposure to emerging trends and industries without selecting individual stocks.

Factors Affecting Risk and Return: Value Stocks vs ETFs

Several factors can affect the risk and return of value stocks and ETFs:

- Company Fundamentals: In value stocks, company earnings, cash flow, and debt levels are crucial. In ETFs, the performance of the underlying assets determines returns.

- Industry Conditions: The performance of both value stocks and ETFs is influenced by industry-specific trends, regulatory changes, and technological advancements.

- Interest Rates: Rising interest rates can impact value stocks, particularly those with high debt. Similarly, ETFs tracking bonds or interest-rate-sensitive sectors can be affected.

- Market Volatility: Both investments are subject to market fluctuations, though ETFs’ diversification can reduce the impact of individual stock movements.

Performance Comparison: Value Stocks vs ETFs

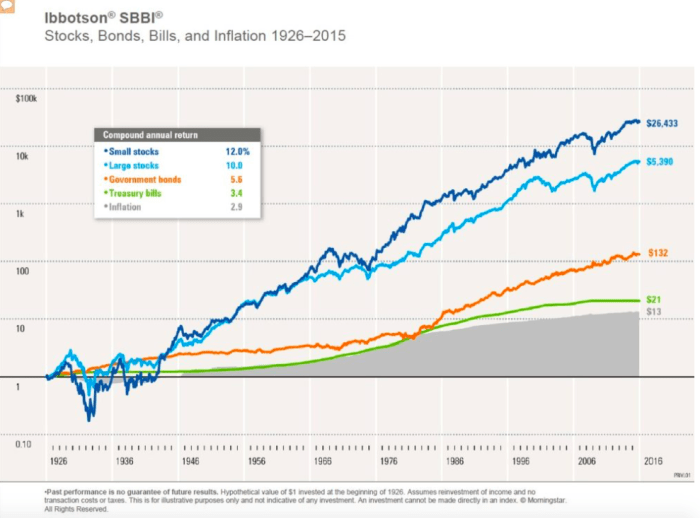

Historically, value stocks have outperformed during market downturns and economic slowdowns, while ETFs have delivered higher returns in bull markets, particularly those with exposure to high-growth sectors.

Value Stocks:

- Long-Term Outperformance: Over extended periods, value stocks tend to outperform growth stocks and ETFs, especially during periods of economic recovery.

- Recent Trends: However, in recent years, ETFs, particularly those tracking high-growth technology sectors, have delivered superior returns compared to value stocks.

ETFs:

- Broad Market Exposure: ETFs that track the broader market often outperform during economic booms, particularly those with heavy allocations to sectors like technology and healthcare.

Tax Considerations for Value Stocks and ETFs

Taxes are an important factor to consider when choosing between value stocks and ETFs. Both are subject to capital gains taxes when sold for a profit, but ETFs often have a slight advantage due to their structure.

Tax Implications for Value Stocks:

- Capital Gains: Investors in value stocks pay capital gains tax when they sell their shares for a profit.

- Dividends: Dividends from value stocks are also taxable, though they may qualify for lower dividend tax rates in certain accounts.

Tax Implications for ETFs:

- Tax Efficiency: ETFs tend to be more tax-efficient than individual stocks because they distribute capital gains to shareholders through dividends, which are often taxed at a lower rate.

- Strategies to Minimize Taxes: Investors can use tax-advantaged accounts, such as IRAs or 401(k)s, and tax-loss harvesting to reduce their overall tax burden.

Market Trends and the Future of Value Stocks and ETFs

Currently, market trends favor ETFs, especially those offering exposure to high-growth sectors like technology. As investors continue to seek diversification and exposure to growth stocks, ETFs remain a popular option.

However, value stocks may become more attractive if economic conditions change, such as rising interest rates or slowing growth. These shifts could lead investors back to undervalued companies with strong fundamentals.

Potential Future Trends:

- Increased Popularity of Thematic ETFs: As investors seek exposure to megatrends, such as clean energy or AI, thematic ETFs are likely to grow in popularity.

- Sustainable Investing: The rise of ESG (environmental, social, and governance) investing is expected to drive demand for ETFs that focus on sustainability.

- Stock Market Volatility: With ongoing market volatility, value stocks could become more attractive as a safe haven for conservative investors.

Final Summary

Both value stocks and ETFs offer unique advantages and challenges for investors. Value stocks provide the potential for steady, long-term returns through dividends and the margin of safety offered by low valuations. On the other hand, ETFs offer diversification, liquidity, and broad market exposure at a lower cost.

Ultimately, your choice between value stocks and ETFs should align with your financial goals, risk tolerance, and time horizon. Many investors choose to incorporate both into their portfolios, balancing the steady returns of value stocks with the growth potential and diversification offered by ETFs.