Value stocks fundamentalsare a compelling investment opportunity, offering both growth and income potential. These stocks are often seen as undervalued by the market, and they typically exhibit financial stability, a key component that makes them attractive to long-term investors. In this guide, we’ll delve into what defines value stocks, how to identify them, and explore both the potential risks and rewards.

Whether you’re a conservative investor looking for dividend income or someone interested in finding undervalued opportunities, this article will help you understand why value stocks with strong fundamentals could be the right choice for your investment strategy.

Table of Contents

ToggleWhat Are Value Stocks with Strong Fundamentals?

At their core, value stocks are shares of companies that are considered undervalued by the market. These companies usually trade at a price lower than their intrinsic value, often due to temporary market factors or specific challenges within their industry. Value stocks with strong fundamentals, however, go beyond mere market pricing – these companies have robust financials that suggest long-term stability and growth potential.

Key characteristics of value stocks include:

- Low price-to-earnings (P/E) ratios: This metric shows that the stock is trading at a discount relative to its earnings.

- Low price-to-book (P/B) ratios: A lower P/B ratio indicates that the stock is priced below its actual book value, or net worth.

- High dividend yields: Companies with strong fundamentals often share their profits with shareholders through dividends, making them appealing for investors seeking passive income.

These traits make value stocks an excellent investment for those looking to balance risk and return. Let’s look deeper into the financial markers that signify a company’s strong fundamentals.

Understanding Financial Health in Value Stocks

1. Low Debt-to-Equity Ratio

A company’s debt-to-equity ratio is a critical indicator of its financial health. For value stocks with strong fundamentals, a low debt-to-equity ratio signifies that the company isn’t overly reliant on debt to finance its operations. This means that even in challenging economic times, the company has a greater likelihood of sustaining its operations and protecting shareholder value.

Debt is not inherently bad, but when a company has too much of it relative to its equity, it faces higher financial risk, including potential difficulty in meeting interest payments. Therefore, low debt-to-equity is one of the most important factors in identifying value stocks with strong fundamentals.

2. Positive Cash Flow from Operations

Cash flow is another vital metric for assessing a company’s financial stability. For value stocks, positive cash flow from operations means that the company is generating enough money through its core business activities to cover its operating expenses. This is crucial for long-term sustainability, as companies that consistently generate positive cash flows can reinvest in growth opportunities, pay dividends, or reduce debt.

3. Strong Balance Sheet

Companies with strong balance sheets have assets that comfortably exceed their liabilities. This financial position not only ensures the company can meet its short-term obligations, but it also suggests a cushion against economic downturns or other unforeseen challenges.

A strong balance sheet can include:

- Substantial cash reserves

- Low levels of long-term debt

- Strong asset quality, such as ownership of tangible assets like real estate or intellectual property

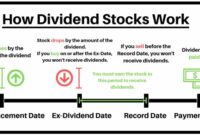

4. Dividend Payments

For conservative investors, dividend stocks are particularly appealing. Many value stocks with strong fundamentals offer high dividend yields, which means they return a significant portion of their earnings to shareholders in the form of dividends. This can provide a steady source of income while you wait for the stock’s price to appreciate over time.

5. Stable Earnings Growth

Consistent earnings growth is another hallmark of strong fundamentals. While value stocks may have temporarily fallen out of favor with the market, their ability to generate steady earnings over time makes them attractive to investors. A company with growing earnings is typically reinvesting in itself, innovating, and staying competitive, which bodes well for its future performance.

How to Identify Value Stocks with Strong Fundamentals

1. Screen for Low P/E and P/B Ratios

The first step in identifying value stocks is to screen for stocks with low price-to-earnings (P/E) and price-to-book (P/B) ratios. A low P/E ratio generally means that the stock is undervalued in relation to its earnings. Similarly, a low P/B ratio suggests the stock is undervalued when compared to the company’s assets.

Both of these metrics, combined with other financial indicators, can help pinpoint value stocks that may be flying under the radar of many investors.

2. Analyze Dividend Yields

High dividend yields are another way to identify value stocks with strong fundamentals. A company that consistently pays dividends, even in downturns, demonstrates financial strength. Companies with solid cash flow and a strong history of dividend payments are less likely to be at risk during economic turbulence.

When analyzing dividends, also consider the payout ratio, which shows what percentage of a company’s earnings are paid out as dividends. A healthy payout ratio indicates that the company can comfortably afford its dividends while still having enough earnings to reinvest in growth.

3. Evaluate Debt Levels

Look for companies with a low debt-to-equity ratio. High debt can erode a company’s value and increase its risk profile, particularly during economic slowdowns or rising interest rates. Low debt levels relative to equity suggest that the company is financially sound and less likely to face liquidity problems in the future.

4. Study Cash Flow and Profit Margins

Cash flow is a more reliable metric than earnings, as it provides insight into how much money the company is actually generating from its business. When identifying value stocks, focus on those with positive operating cash flow and healthy profit margins. This signals that the company is not only earning profits but is also efficient in managing its costs.

Risks of Investing in Value Stocks

While value stocks with strong fundamentals can offer substantial long-term rewards, they also come with risks. Understanding these risks will help you make informed decisions.

1. Value Trap

A common risk when investing in value stocks is falling into what’s known as a value trap. This happens when a stock appears undervalued based on traditional metrics like P/E or P/B ratios, but it continues to underperform because of underlying issues with the company, such as outdated business models, declining industries, or weak management.

2. Extended Market Discount

Another risk is that the stock may continue to trade at a discount to its intrinsic value for an extended period. While you wait for the market to recognize the stock’s true value, you might experience limited price appreciation. This is why patience is key in value investing.

3. Macro-Economic Factors

Even companies with strong fundamentals can be affected by macro-economic factors, such as inflation, interest rate hikes, or broader market downturns. For example, during recessions, consumer demand may drop, impacting earnings across various sectors, even for companies with a strong balance sheet and stable earnings.

4. Changes in Company Fundamentals

Another risk is the possibility of a deterioration in the company’s fundamentals. Even the most financially sound companies can face challenges such as increased competition, changes in consumer preferences, or technological disruptions. Regularly reviewing the company’s financial health is critical to mitigate this risk.

Best Value Stocks for Conservative Investors

For conservative investors, the best approach is to focus on dividend-paying value stocks. These stocks not only offer potential price appreciation but also provide a regular income stream through dividends. Examples of sectors that often have high-quality value stocks with strong dividends include:

- Utilities

- Consumer staples

- Healthcare

- Financial services

These industries tend to have more stable earnings and are less susceptible to economic cycles, making them ideal for conservative investors seeking long-term growth and dividend income.

If you’re interested in exploring current top dividend stocks, you might want to check out this useful guide to top dividend stocks for 2024.

Conclusion

Investing in value stocks with strong fundamentals can be a highly rewarding strategy for long-term investors. By focusing on companies with low P/E and P/B ratios, high dividend yields, and solid financial health, you can identify stocks that offer both capital appreciation and dividend income.

While there are risks involved, such as the potential for value traps or extended market discounts, a careful analysis of a company’s financial health can help mitigate these risks. In the long run, value stocks tend to outperform, especially when bought at a discount and held as the market eventually recognizes their true worth.