Leverage in Forex Trading: – , or foreign exchange trading, has become increasingly popular, attracting traders from all walks of life. One of the reasons behind this popularity is the opportunity to leverage Forex trading, enabling traders to maximize potential gains with a smaller initial investment. In this comprehensive guide, we will explore the concept of leverage, how it works, and the benefits and risks associated with it. We’ll also cover practical tips to manage risks effectively when using leverage.

Let’s dive into the world of leverage in Forex trading and discover how you can make it work to your advantage.

What is Leverage in Forex Trading?

Understanding the Basics of Leverage

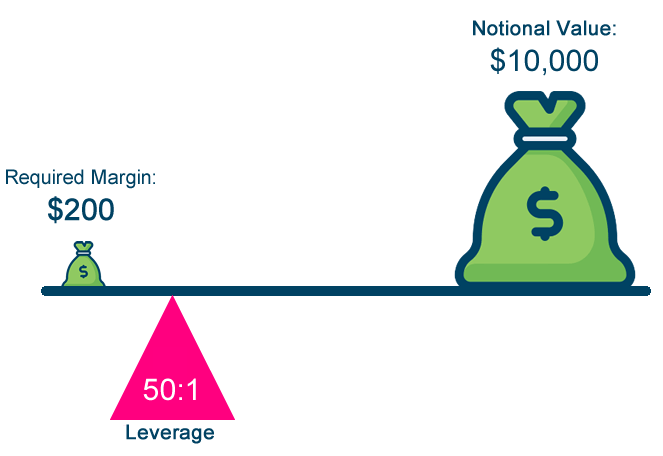

In simple terms, leverage in Forex trading refers to borrowing funds from your broker to increase your trading position beyond what your initial investment would allow. It is a financial tool that allows traders to control a larger market position with a relatively smaller amount of capital, referred to as the “margin.”

For instance, if you have a leverage ratio of 50:1, you can control $50,000 worth of currency with just $1,000 in your trading account. This increases the potential profit but also amplifies the risk of losses. The common leverage ratios in Forex range from 50:1 to 500:1, depending on the broker and the regulatory requirements in your country.

How Does Leverage Work?

Here’s a practical example to illustrate how leverage in Forex trading works:

- You decide to trade the EUR/USD currency pair with a leverage of 100:1.

- You have $1,000 in your trading account.

- With a 100:1 leverage, you can open a position worth $100,000.

- A small movement of 1% in the EUR/USD exchange rate could yield a significant profit or loss compared to your initial $1,000 investment.

Therefore, understanding how to manage leverage effectively is crucial to successful Forex trading.

The Advantages of Leverage in Forex Trading

Higher Profit Potential

The most attractive feature of using leverage in Forex trading is the potential to earn higher profits. By controlling a larger position, even small changes in the currency price can result in significant gains. Traders who understand market trends and can make accurate predictions often use leverage to maximize their returns.

For example, with a 100:1 leverage, a mere 1% increase in the value of your position can lead to a 100% return on your initial investment. This amplifies the appeal of Forex trading, especially for experienced traders.

Flexibility and Accessibility

Leverage makes Forex trading accessible to individuals who might not have substantial capital. Instead of needing thousands of dollars to trade major currency pairs, beginners can start with a smaller deposit and still participate actively in the Forex market.

Many brokers offer mini and micro accounts, allowing new traders to use leverage without putting a large amount of capital at risk. This flexibility makes Forex trading appealing to a broad audience.

Ability to Diversify Investments

With leverage, traders can diversify their investments by controlling multiple positions simultaneously. For instance, a trader with $5,000 in capital and a 50:1 leverage could open several trades in different currency pairs, spreading risk and increasing the chance of profiting from favorable market conditions.

This strategy allows traders to capitalize on various market trends, reducing dependency on a single trade.

The Risks of Using Leverage in Forex Trading

Increased Risk of Loss

While the potential for profit is higher, the risk of loss is also significantly increased with leverage. A small adverse movement in the market can result in substantial losses, especially if traders are not using effective risk management strategies.

For instance, a 1% loss on a $100,000 position with a 100:1 leverage could wipe out a trader’s initial $1,000 investment. This is why it’s essential to understand the risks and have a solid strategy in place.

Margin Call: A Potential Pitfall

When trading with leverage, you must maintain a certain amount of capital in your account to cover potential losses. If the market moves against you, and your losses exceed the available margin, you might receive a margin call from your broker. This means you have to deposit additional funds or close your position to prevent further losses.

Failing to meet a margin call could result in the automatic liquidation of your trades, leading to significant financial loss. Always monitor your account to ensure you have enough funds to support your leveraged positions.

Overleveraging: A Common Mistake

One of the most common mistakes new traders make is overleveraging—using too much leverage for their skill level and trading capital. Overleveraging can lead to emotional trading, irrational decision-making, and ultimately, severe losses. It’s crucial to find the right balance between leverage and risk to protect your trading capital.

How to Manage Risks When Using Leverage in Forex Trading

Use Stop-Loss Orders

A stop-loss order is a powerful tool that helps limit potential losses by closing a trade automatically when the market reaches a predefined level. It’s one of the most effective risk management strategies when using leverage. Setting a stop-loss order allows you to define the maximum loss you’re willing to accept, reducing the emotional burden during volatile market conditions.

For example, if you’re trading EUR/USD with a leverage of 100:1, setting a stop-loss 1% below the entry price can help prevent catastrophic losses if the market moves against you.

Trade with a Solid Plan

Before you start trading with leverage, develop a comprehensive trading plan that includes your risk tolerance, profit targets, and market analysis. A well-structured plan will guide your decisions and prevent you from making impulsive trades based on short-term market fluctuations.

Your trading plan should include:

- Clear entry and exit points

- Appropriate leverage levels based on your experience

- Risk-reward ratios to evaluate potential trades

- Timeframes for each trade

Keep Your Leverage in Check

Many experts recommend using lower leverage, especially for beginners. While brokers may offer high leverage ratios like 400:1 or 500:1, using such extreme leverage can be risky if you’re not an experienced trader. Instead, start with a lower leverage ratio like 10:1 or 20:1 and increase gradually as you gain confidence and experience.

By keeping your leverage at a manageable level, you can mitigate the risk of significant losses.

Diversify Your Trading Portfolio

Diversification is a proven strategy to reduce risk in any financial market, including Forex. By spreading your investments across different currency pairs, you can lower the overall risk of your portfolio. Even if one trade performs poorly, other trades in your portfolio may offset the losses.

Consider using leverage wisely to diversify your trades without putting all your capital into a single currency pair.

Monitor Market Conditions Regularly

Keeping a close eye on the Forex market is essential when trading with leverage. Economic indicators, geopolitical events, and central bank policies can significantly impact currency prices. Regularly monitoring the market will help you make informed decisions and adjust your strategy according to changing conditions.

Staying updated with Forex news can also help you avoid unexpected market volatility that might lead to a margin call.

Current Trends in Forex Trading Leverage

Regulatory Changes and Leverage Limits

Due to the risks associated with high leverage, many regulatory bodies have introduced limits to protect retail traders. In Europe, for example, the European Securities and Markets Authority (ESMA) limits leverage for major currency pairs to 30:1 and for minors to 20:1. In the United States, the Commodity Futures Trading Commission (CFTC) restricts leverage to 50:1 for major pairs.

These regulations aim to ensure that traders use leverage responsibly, reducing the likelihood of devastating losses for inexperienced traders.

The Growing Popularity of Social Trading Platforms

Social trading platforms have emerged as a popular trend, allowing traders to follow and copy the trades of experienced investors. These platforms often feature leverage options, enabling traders to replicate high-leverage strategies without extensive knowledge of the market.

However, relying solely on social trading without understanding the risks can be dangerous. It’s essential to analyze the strategies being copied and assess whether the use of leverage aligns with your risk tolerance.

Impact of Technology on Leveraged Forex Trading

Technology has revolutionized the Forex market, making it easier to access real-time data, execute trades, and analyze trends. Advanced trading platforms now offer tools like automated trading, risk calculators, and technical analysis indicators, allowing traders to use leverage more effectively.

Automated trading systems, for instance, can be programmed to use leverage according to specific rules, reducing the emotional factor in trading and improving overall risk management.

Making Leverage Work for You in Forex Trading

Leverage in Forex trading is a double-edged sword, offering the potential for substantial profits while exposing traders to significant risks. Understanding how leverage works, its benefits, and its drawbacks is essential for any trader looking to navigate the Forex market successfully.

By employing sound risk management strategies—such as using stop-loss orders, developing a solid trading plan, keeping leverage in check, and staying updated on market conditions—you can make leverage work in your favor. Start with a lower leverage ratio if you’re new to Forex trading and increase it as you gain more experience and confidence.

For more in-depth insights into Forex trading strategies and risk management, check out resources from established Forex education sites like Investopedia for detailed guides and tutorials.