Range trading strategy is a profitable trading technique that involves identifying and trading within a specific price range. Unlike other strategies that rely on market trends, range trading capitalizes on the predictable fluctuations within a defined range, making it an ideal approach for both beginners and experienced traders.

By understanding the principles of range trading, traders can develop a systematic approach to identify trading opportunities, manage risk, and maximize profits.

While range trading strategy involves identifying and trading within a defined price range, forex momentum trading takes a different approach. It seeks to capitalize on the strength of a currency’s trend, entering and exiting positions based on momentum indicators.

By incorporating forex momentum trading into a range trading strategy, traders can potentially enhance their profit potential by capturing both range-bound and trending market conditions.

Range Trading Strategy Overview

Range trading is a trading strategy that involves buying and selling a financial instrument within a defined price range. The goal of range trading is to profit from the repeated price fluctuations within this range.

Range trading strategies involve capitalizing on the price fluctuations within a defined range. To implement this strategy effectively, consider opening a forex account with a reputable broker.

This allows access to various currency pairs and leverage options, enabling traders to execute range trading strategies and potentially profit from market movements within the predefined range.

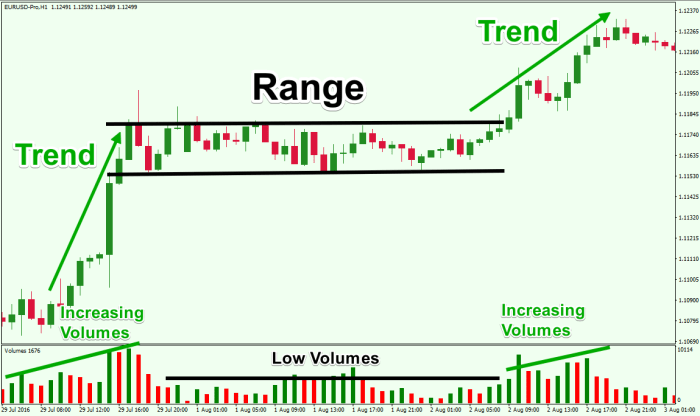

Range trading differs from other trading strategies in that it does not attempt to predict the direction of the market. Instead, it focuses on identifying and trading within price ranges that have been established by support and resistance levels.

Examples of range trading strategies include:

- Trading between the support and resistance levels of a trend channel

- Trading within the Bollinger Bands of a security

- Trading within the range defined by a moving average and its standard deviation

Identifying Trading Ranges

Technical indicators used to identify trading ranges include:

- Support and resistance levels

- Moving averages

- Bollinger Bands

- Parabolic SAR

- Ichimoku Cloud

To determine support and resistance levels, traders can use historical price data to identify areas where the price has consistently bounced off.

Chart patterns associated with range trading include:

- Triangles

- Rectangles

- Flags

- Pennants

Entry and Exit Points, Range trading strategy

Different methods for entering and exiting range trades include:

- Entering at support or resistance levels

- Entering at the breakout of a trading range

- Exiting at the opposite support or resistance level

- Exiting at a predetermined profit target

Stop-loss and take-profit orders are important risk management tools that can help traders limit their losses and lock in profits.

Examples of entry and exit strategies based on technical analysis include:

- Entering a long trade when the price breaks above a resistance level

- Exiting a long trade when the price falls below a support level

- Entering a short trade when the price breaks below a support level

- Exiting a short trade when the price rises above a resistance level

Summary: Range Trading Strategy

Range trading strategy offers a unique opportunity for traders to profit from market fluctuations without the need for precise trend predictions. By mastering the techniques Artikeld in this guide, traders can develop a profitable and consistent trading plan that aligns with their risk tolerance and financial goals.

FAQ Explained

What are the advantages of range trading?

Range trading offers several advantages, including reduced risk compared to trend trading, the ability to profit from both bullish and bearish markets, and the potential for consistent returns.

Range trading strategy involves identifying and trading within a specific price range. While this strategy can be effective in certain market conditions, it may not be suitable when the market is trending.

In such cases, traders may consider exploring Forex trend trading , which focuses on identifying and trading in the direction of the prevailing trend.

However, it’s important to note that range trading strategy can still be a valuable tool for traders who prefer to trade within defined price ranges.

How do I identify trading ranges?

Traders can identify trading ranges using technical indicators such as support and resistance levels, moving averages, and Bollinger Bands.

What are the common entry and exit strategies for range trading?

Common entry strategies include buying at support levels and selling at resistance levels. Exit strategies may involve taking profits at the opposite end of the range or using stop-loss orders to limit potential losses.