How to grow wealth with dividend stocks – In the realm of investing, dividend stocks stand as a beacon of wealth creation, offering investors a steady stream of passive income and the potential for long-term capital appreciation. This comprehensive guide will delve into the intricacies of dividend investing, empowering you with the knowledge and strategies to harness its power for financial growth.

While dividend stocks can provide a steady stream of passive income, it’s important to consider the potential for growth as well. By diversifying your portfolio with growth stocks that offer high returns on investment, you can potentially accelerate your wealth-building journey.

However, it’s crucial to balance the pursuit of growth with careful due diligence and risk management to ensure long-term success in growing your wealth through dividend stocks.

From understanding the fundamentals of dividend stocks to selecting high-quality investments, building a diversified portfolio, and navigating tax implications, this guide will provide you with a roadmap to success in the world of dividend investing.

Understanding Dividend Stocks

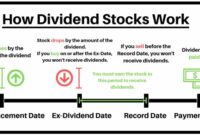

Dividend stocks are a type of stock that pays regular dividends to its shareholders. Dividends are a portion of a company’s earnings that are distributed to shareholders as a reward for their investment. Investing in dividend stocks can be a powerful way to grow wealth over time.

One strategy for building wealth is to invest in dividend-paying stocks. These stocks provide a regular income stream that can be reinvested to compound your returns over time. However, it’s important to diversify your portfolio by investing in both dividend stocks and growth stocks.

Growth stocks have the potential to generate higher returns over the long term, but they also come with more risk. By diversifying your portfolio, you can reduce your overall risk and increase your chances of achieving your financial goals.

There are several advantages to investing in dividend stocks. First, dividends can provide a steady stream of income. This can be especially helpful for investors who are nearing retirement or who need additional income to supplement their earnings. Second,

dividend stocks can help to reduce portfolio volatility. This is because dividends are typically paid out even during periods of economic downturn, when stock prices may be declining.

Selecting Dividend Stocks, How to grow wealth with dividend stocks

Not all dividend stocks are created equal. When selecting dividend stocks, it is important to consider the following factors:

- Dividend yield: The dividend yield is the annual dividend per share divided by the current stock price. A high dividend yield can be attractive, but it is important to remember that dividend yields can change over time.

- Payout ratio: The payout ratio is the percentage of a company’s earnings that are paid out as dividends. A high payout ratio can be a sign that a company is not reinvesting enough in its business.

- Company fundamentals: It is important to consider the overall financial health of a company before investing in its dividend stock. Factors to consider include the company’s revenue, earnings, and debt.

Building a Dividend Portfolio

Once you have selected a few dividend stocks, you can start to build a dividend portfolio. It is important to diversify your portfolio by investing in a variety of dividend stocks from different industries and sectors. This will help to reduce your risk.

You should also consider your investment goals when building a dividend portfolio. If you are looking for a steady stream of income, you may want to focus on stocks with high dividend yields.

If you are looking for long-term growth, you may want to focus on stocks with lower dividend yields but higher growth potential.

Monitoring and Rebalancing: How To Grow Wealth With Dividend Stocks

It is important to monitor your dividend portfolio on a regular basis. This will help you to identify any stocks that are underperforming or that are no longer meeting your investment goals.

You should also rebalance your portfolio periodically. This means selling some of your winners and buying more of your losers. This will help to ensure that your portfolio remains diversified and that you are maximizing your returns.

Tax Implications

Dividend income is taxed at different rates depending on your income and filing status. Qualified dividends are taxed at a lower rate than ordinary income. Non-qualified dividends are taxed at your ordinary income tax rate.

There are several strategies that you can use to minimize your tax liability on dividend income. One strategy is to invest in dividend stocks that are held in a tax-advantaged account, such as an IRA or 401(k).

Dividend stocks can be a great way to grow your wealth over time, but they’re not the only option. If you’re looking for stocks with the potential for high growth, you may want to consider growth stocks. Growth stocks are companies that are expected to grow rapidly in the future, and they can offer investors the potential for significant returns.

However, it’s important to remember that growth stocks can also be more volatile than dividend stocks, so it’s important to do your research before investing.

Real-World Examples

There are many successful dividend investors who have used dividend stocks to grow their wealth. One example is Warren Buffett. Buffett is one of the most successful investors in history, and he has made a significant portion of his wealth by investing in dividend stocks.

Another example of a successful dividend investor is John Templeton. Templeton was a pioneer in the field of global investing, and he made a fortune by investing in dividend stocks from around the world.

Additional Considerations

There are a few additional considerations that you should keep in mind when investing in dividend stocks.

- Dividend reinvestment plans (DRIPs): DRIPs allow you to automatically reinvest your dividends in more shares of the same stock. This can be a great way to build your wealth over time.

- Options: Options can be used to enhance your dividend income. For example, you can buy call options on dividend stocks to increase your potential return.

- Managing dividend income in retirement: If you are planning to retire, it is important to consider how you will manage your dividend income. You may want to consider setting up a systematic withdrawal plan to ensure that you have a steady stream of income in retirement.

Conclusion

Dividend investing is a powerful tool for building wealth over time, but it requires careful planning and execution. By following the strategies Artikeld in this guide, you can harness the potential of dividend stocks to achieve your financial goals and secure a more prosperous future.

FAQ Insights

What are the advantages of investing in dividend stocks?

Dividend stocks offer a steady stream of passive income, potential for capital appreciation, diversification benefits, and a hedge against inflation.

How do I select high-quality dividend stocks?

Consider factors such as dividend yield, payout ratio, company fundamentals, and industry outlook.

How do I build a diversified dividend portfolio?

Allocate assets across different sectors, industries, and company sizes to reduce risk and enhance returns.

What are the tax implications of dividend income?

Dividend income is taxed at different rates depending on the type of dividend and your tax bracket. Qualified dividends are taxed at a lower rate than ordinary dividends.