Forex volatility trading involves capitalizing on price fluctuations in the foreign exchange market. Understanding volatility, employing effective strategies, utilizing technical indicators, and implementing sound risk management techniques are crucial for success in this dynamic trading environment.

Volatility in the Forex market is influenced by economic data releases, political events, and market sentiment. Traders can identify trading opportunities by analyzing volatility using technical indicators such as Bollinger Bands, Average True Range (ATR), and the Volatility Index (VIX).

Forex volatility trading involves capitalizing on price fluctuations in the foreign exchange market. To get started, you need to open a forex account with a reputable broker.

This account will allow you to access the market and execute trades. Understanding the risks and strategies involved in forex volatility trading is crucial before engaging in this dynamic market.

Understanding Forex Volatility Trading

Forex volatility trading involves speculating on the price fluctuations of currency pairs. Volatility refers to the degree of price movement within a given time frame. Understanding the factors that influence volatility is crucial for successful trading.

Volatility in Forex markets is driven by various factors, including economic data releases, political events, central bank announcements, and market sentiment.

These factors can cause significant price swings, creating opportunities for traders to profit from market fluctuations.

Strategies for Forex Volatility Trading

There are several strategies for trading Forex volatility, each with its own advantages and risks. Some popular strategies include:

- Range trading: Involves trading within a defined price range, profiting from price fluctuations within that range.

- Breakout trading: Identifies and trades breakouts from predefined price levels, anticipating significant price movements.

- News trading: Speculates on the impact of news events on currency prices, aiming to profit from short-term market volatility.

Technical Indicators for Volatility Trading

Technical indicators are tools used to analyze price data and identify potential trading opportunities. Some commonly used indicators for volatility trading include:

- Bollinger Bands: Measure price volatility and identify potential breakout levels.

- Average True Range (ATR): Indicates the average price range over a specified period.

- Relative Strength Index (RSI): Measures the momentum of price changes and identifies overbought or oversold conditions.

Risk Management in Volatility Trading

Risk management is paramount in volatility trading. Traders should:

- Set clear profit and loss targets.

- Use stop-loss orders to limit potential losses.

- Manage position size to avoid excessive risk.

- Monitor market conditions and adjust strategies as needed.

Case Studies of Successful Volatility Traders

Studying the strategies and techniques of successful volatility traders can provide valuable insights. Some notable examples include:

- George Soros: Known for his successful currency trades during the 1992 Black Wednesday crisis.

- Bill Lipschutz: A hedge fund manager who has achieved significant returns through volatility trading.

- Joe DiNapoli: Developed the DiNapoli Volatility Indicator, widely used by traders to measure market volatility.

Last Point

Forex volatility trading offers both opportunities and risks. By understanding volatility, implementing effective strategies, utilizing technical indicators, and employing sound risk management practices, traders can navigate the complexities of this market and potentially achieve positive returns.

Popular Questions: Forex Volatility Trading

What is Forex volatility trading?

Forex volatility trading seeks to profit from fluctuations in currency exchange rates. Forex momentum trading is a strategy that attempts to capitalize on price trends by trading in the direction of the momentum.

This can be complementary to volatility trading, as momentum trading can identify potential trading opportunities within volatile markets.

Forex volatility trading involves profiting from price fluctuations in the foreign exchange market by predicting and capitalizing on periods of high volatility.

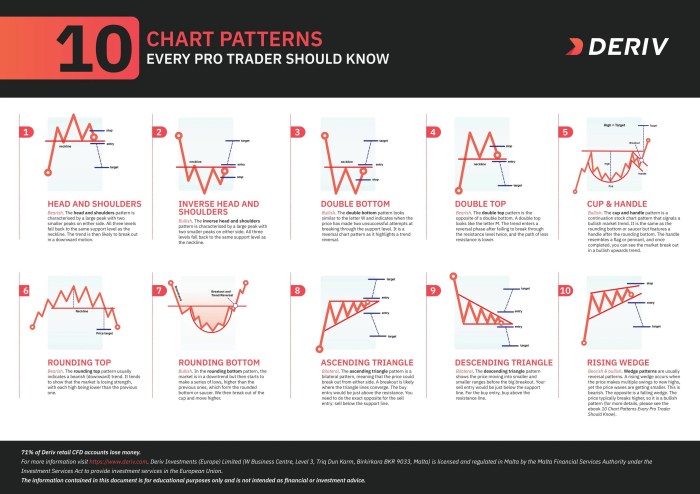

Forex volatility trading thrives on market fluctuations. To effectively navigate these movements, traders often analyze Forex trading patterns. These patterns provide insights into price trends, allowing traders to make informed decisions.

By understanding how price action tends to behave in different scenarios, traders can identify potential opportunities and mitigate risks in the volatile Forex market.

How do you measure Forex volatility?

Forex volatility can be measured using technical indicators such as Bollinger Bands, Average True Range (ATR), and the Volatility Index (VIX), which provide insights into market volatility levels.

What are the risks of Forex volatility trading?

Forex volatility trading carries risks, including potential losses due to unpredictable market movements, leverage risks, and the need for constant monitoring.