Forex trend lines, a cornerstone of technical analysis, empower traders with invaluable insights into market direction. Join us as we unravel their significance, explore their types, and delve into their practical applications for maximizing trading success.

From identifying trend lines with precision to leveraging them for strategic entry and exit points, this comprehensive guide equips you with the knowledge and techniques to harness the power of Forex trend lines.

Forex trend lines provide a visual representation of price movements, helping traders identify potential trading opportunities. However, determining where to take profits can be equally important.

Forex profit targets can be set based on various factors, such as risk tolerance and technical analysis.

By understanding both trend lines and profit targets, traders can develop a comprehensive trading strategy that maximizes their chances of success.

Introduction to Forex Trend Lines

Trend lines are a fundamental tool in technical analysis, providing traders with a visual representation of the overall trend of a currency pair. They connect a series of price highs or lows, indicating the direction and momentum of the market.

Forex trend lines provide valuable insights into market direction, helping traders identify potential trading opportunities. However, it’s essential to understand the psychological factors that influence trading decisions.

Forex trading psychology explores the mental and emotional aspects of trading, highlighting the importance of managing emotions, controlling risk, and developing a disciplined trading plan.

By integrating psychological principles with technical analysis, traders can enhance their understanding of Forex trend lines and make more informed trading decisions.

Trend lines are essential for understanding market behavior and making informed trading decisions. By identifying and interpreting trend lines, traders can anticipate future price movements and adjust their strategies accordingly.

Types of Trend Lines

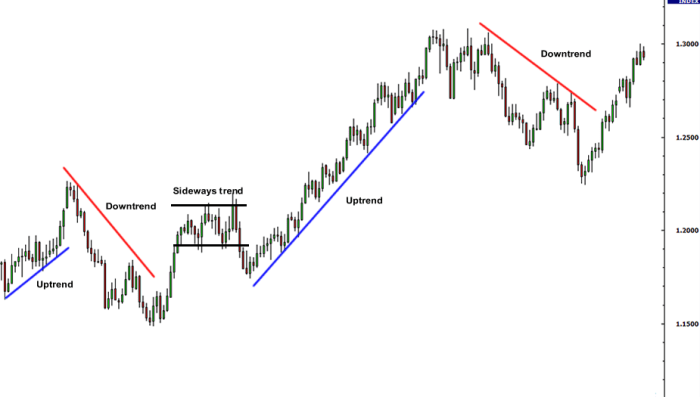

There are three main types of trend lines:

- Ascending trend lines: Connect a series of higher lows, indicating an upward trend.

- Descending trend lines: Connect a series of lower highs, indicating a downward trend.

- Horizontal trend lines: Connect a series of highs or lows at approximately the same price level, indicating a sideways trend.

Identifying Trend Lines

Identifying trend lines requires careful observation of price action. Traders can use the following methods:

- Connect two or more swing highs or lows: This is the most basic method for drawing trend lines.

- Use a moving average: Moving averages can help smooth out price fluctuations and make it easier to identify trends.

- Consider support and resistance levels: Support and resistance levels can often coincide with trend lines.

Using Trend Lines for Trading: Forex Trend Lines

Trend lines can be used to identify entry and exit points for trades:

- Breakouts: When the price breaks through a trend line, it can indicate a change in trend and a potential trading opportunity.

- Retracements: After a breakout, the price may retrace back towards the trend line before continuing in the new direction.

- Stop-loss and take-profit levels: Trend lines can be used to set stop-loss and take-profit levels, protecting profits and limiting losses.

Limitations of Trend Lines

Trend lines are not foolproof and have the following limitations:

- False signals: Trend lines can sometimes provide false signals, especially during periods of consolidation or volatility.

- Importance of combining with other technical indicators: Trend lines should not be used in isolation. They should be combined with other technical indicators for confirmation.

Advanced Trend Line Analysis

Traders can enhance their trend line analysis by using advanced techniques:

- Moving averages and trend lines: Moving averages can be used to confirm trend lines and identify potential trading opportunities.

- Fibonacci retracement levels and trend lines: Fibonacci retracement levels can be used to identify potential support and resistance levels along a trend line.

- Price action and trend lines: Price action can provide valuable insights into the strength and validity of a trend line.

Final Review

In the ever-evolving landscape of Forex trading, trend lines stand as a timeless tool, guiding traders towards informed decisions and enhanced profitability. Embrace the insights shared in this guide, and elevate your trading prowess to new heights.

Popular Questions

What are the different types of Forex trend lines?

Forex trend lines come in three primary types: ascending, descending, and horizontal.

How do I identify trend lines accurately?

Identifying trend lines involves connecting at least two consecutive highs or lows on a price chart.

Forex trend lines are an effective tool for identifying potential price movements. By combining them with the Bollinger Bands strategy , traders can gain further insights into market trends. Bollinger Bands provide a visual representation of volatility, helping traders identify overbought and oversold conditions.

By incorporating this strategy into their analysis, traders can enhance their understanding of Forex trend lines and make more informed trading decisions.

Can trend lines provide false signals?

While trend lines offer valuable insights, they can occasionally generate false signals. Combining them with other technical indicators mitigates this risk.