Forex trading psychology is the cornerstone of successful trading, shaping traders’ decisions and outcomes. It delves into the intricate interplay between emotions, cognitive biases, and trading behavior, providing a roadmap to navigate the psychological challenges that often derail traders.

Understanding the psychological aspects of Forex trading empowers traders to develop a resilient mindset, manage emotions effectively, and overcome common challenges. This journey of self-discovery and psychological mastery unlocks the potential for consistent profitability and long-term success in the dynamic world of Forex trading.

Understanding Forex Trading Psychology

Forex trading psychology involves understanding the mental and emotional factors that influence traders’ decisions and outcomes. Emotions like fear, greed, and hope can significantly impact trading,

leading to irrational decisions and financial losses. Psychological biases, such as overconfidence and confirmation bias, can further distort traders’ perceptions and judgments.

In the realm of Forex trading, psychology plays a pivotal role in determining success. Mastering the mental game is essential for navigating the unpredictable market conditions.

Volatility, a key characteristic of the Forex market, can be a double-edged sword. By embracing Forex volatility trading , traders can capitalize on market fluctuations while mitigating risks.

However, the psychological impact of volatility cannot be underestimated. Maintaining a clear and disciplined mindset is crucial for making sound trading decisions in the face of market turbulence.

Developing a Strong Trading Mindset

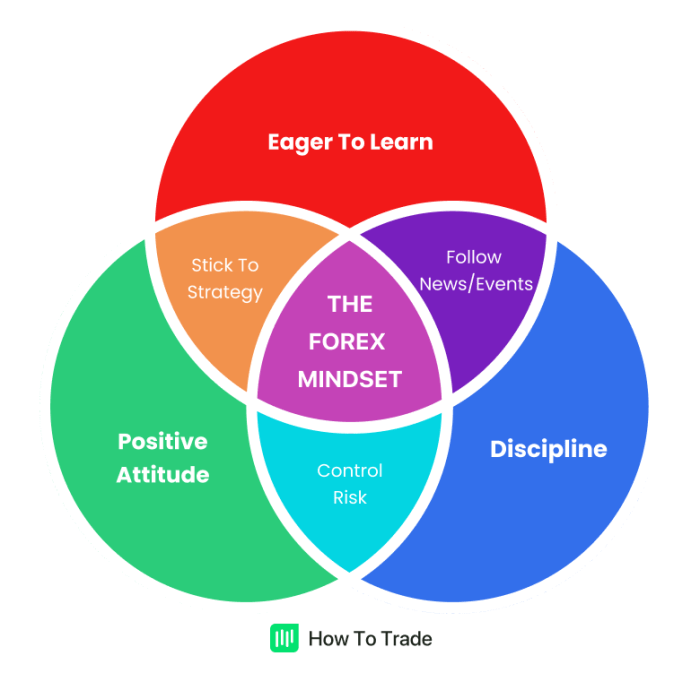

Successful Forex traders possess a positive and disciplined mindset that enables them to manage emotions, stay focused, and make rational decisions.

They cultivate self-awareness, develop a trading plan, and practice risk management to mitigate the impact of negative emotions. Techniques like visualization, affirmations, and meditation can help traders enhance their mental strength and emotional resilience.

Emotional Management Strategies

Emotional management is crucial in Forex trading. Strategies to control fear include recognizing triggers, practicing relaxation techniques, and developing contingency plans.

To combat greed, traders should set realistic profit targets, avoid overleveraging, and focus on long-term gains. Journaling and self-reflection can help traders identify emotional patterns and develop coping mechanisms.

Forex trading psychology is a crucial aspect of success in the markets, as it can influence traders’ decision-making and risk management. One common approach to trading is Forex trend trading , which involves identifying and following the prevailing market trend.

Understanding trend trading can help traders develop a more disciplined approach to their trading, as it provides a framework for analyzing price movements and making informed decisions.

However, it’s important to remember that even in trend trading, psychology plays a significant role, as traders must manage their emotions and avoid making impulsive decisions that could jeopardize their trading performance.

Overcoming Common Psychological Challenges

Forex traders face psychological challenges such as FOMO (fear of missing out) and the need for validation. To overcome FOMO, traders should develop a trading plan, stick to it, and avoid impulsive decisions.

Seeking validation from external sources can lead to overtrading and poor decision-making. Instead, traders should focus on self-validation through consistent effort and progress.

The Role of Education and Support

Education plays a vital role in developing a strong Forex trading psychology. Traders should seek knowledge from reputable sources, attend workshops, and engage with experienced traders.

Mentors, coaches, and trading communities can provide guidance, support, and accountability, helping traders overcome psychological barriers and achieve success.

Case Studies and Examples

Case studies of successful Forex traders who have overcome psychological challenges can provide valuable insights. Analyzing their strategies and mindset highlights the importance of psychology in trading success.

Real-life examples demonstrate how psychological factors, both positive and negative, have influenced trading outcomes and shaped traders’ careers.

Table of Emotional Management Techniques

| Emotion | Description | Impact on Trading | Management Strategies |

|---|---|---|---|

| Fear | Anxiety about potential losses | Hesitation, missed opportunities | Identify triggers, practice relaxation techniques, develop contingency plans |

| Greed | Excessive desire for profits | Overleveraging, unrealistic expectations | Set realistic profit targets, avoid overtrading, focus on long-term gains |

| Hope | Unfounded optimism about market outcomes | Ignoring risk, holding onto losing positions | Develop a trading plan, stick to it, avoid wishful thinking |

| Regret | Emotional response to missed opportunities or poor decisions | Self-doubt, impulsive trading | Analyze mistakes objectively, learn from them, avoid dwelling on the past |

Infographic on Psychological Biases

Create an infographic that visually represents common psychological biases in Forex trading, including examples, explanations, and tips for overcoming them. Use a visually appealing format to illustrate the concepts clearly.

Forex trading psychology is crucial for successful trading. It involves managing emotions, staying disciplined, and controlling risk.

To enhance trading psychology, it’s essential to implement a robust Forex risk management strategy. By defining risk tolerance, setting stop-loss levels, and diversifying investments, traders can mitigate potential losses and protect their capital.

This, in turn, fosters confidence and reduces stress, allowing traders to make informed decisions and maintain a positive trading mindset.

Last Word

Forex trading psychology is not merely a buzzword but a fundamental pillar of trading success. By embracing the principles Artikeld in this comprehensive guide, traders can transform their trading mindset, cultivate emotional resilience, and overcome psychological barriers.

The rewards of mastering Forex trading psychology extend beyond financial gains, fostering personal growth, discipline, and a newfound confidence in the face of market volatility.

Remember, the path to Forex trading mastery begins with understanding and conquering the psychological challenges that lie within. Embrace the journey of self-discovery and psychological empowerment, and unlock the true potential that lies within you as a Forex trader.

Questions Often Asked: Forex Trading Psychology

What are the common psychological challenges faced by Forex traders?

Forex traders often grapple with psychological challenges such as fear of missing out (FOMO), the need for validation, overconfidence, and the inability to accept losses.

How can traders develop a strong trading mindset?

Developing a strong trading mindset involves cultivating discipline, managing emotions, setting realistic expectations, and embracing a growth mindset that values learning from mistakes.

What are some effective emotional management strategies for Forex traders?

Effective emotional management strategies for Forex traders include journaling, self-reflection, mindfulness techniques, and seeking support from mentors or trading communities.