Forex trading patterns offer a powerful tool for traders seeking to navigate the complexities of the foreign exchange market. By recognizing and interpreting these patterns, traders can gain valuable insights into market trends and make informed trading decisions.

This comprehensive guide delves into the world of forex trading patterns, providing a detailed overview of their significance, identification techniques, and application in developing effective trading strategies.

Forex Trading Patterns Overview

Forex trading patterns are recognizable formations in currency price charts that can indicate potential future price movements. By identifying and interpreting these patterns, traders can make informed trading decisions and increase their chances of success.

Common forex trading patterns include trendlines, support and resistance levels, and candlestick patterns. Trendlines connect a series of price highs or lows to identify the overall trend direction. Support and resistance levels are horizontal lines that represent areas where the price has consistently bounced off, indicating potential reversal points.

Candlestick patterns are formed by the combination of open, close, high, and low prices over a specific time period, and each pattern has its own unique implications for future price movements.

Identifying Forex Trading Patterns

Identifying forex trading patterns requires a combination of technical analysis and chart interpretation skills. Technical indicators, such as moving averages and oscillators, can help traders identify potential patterns by smoothing out price

fluctuations and highlighting trends. Chart analysis involves studying the price action itself, looking for specific formations that match known patterns.

Effective pattern identification requires patience and practice. Traders should look for patterns that are clear and well-defined, and they should consider the overall market context when interpreting patterns.

Trading Strategies Based on Forex Trading Patterns

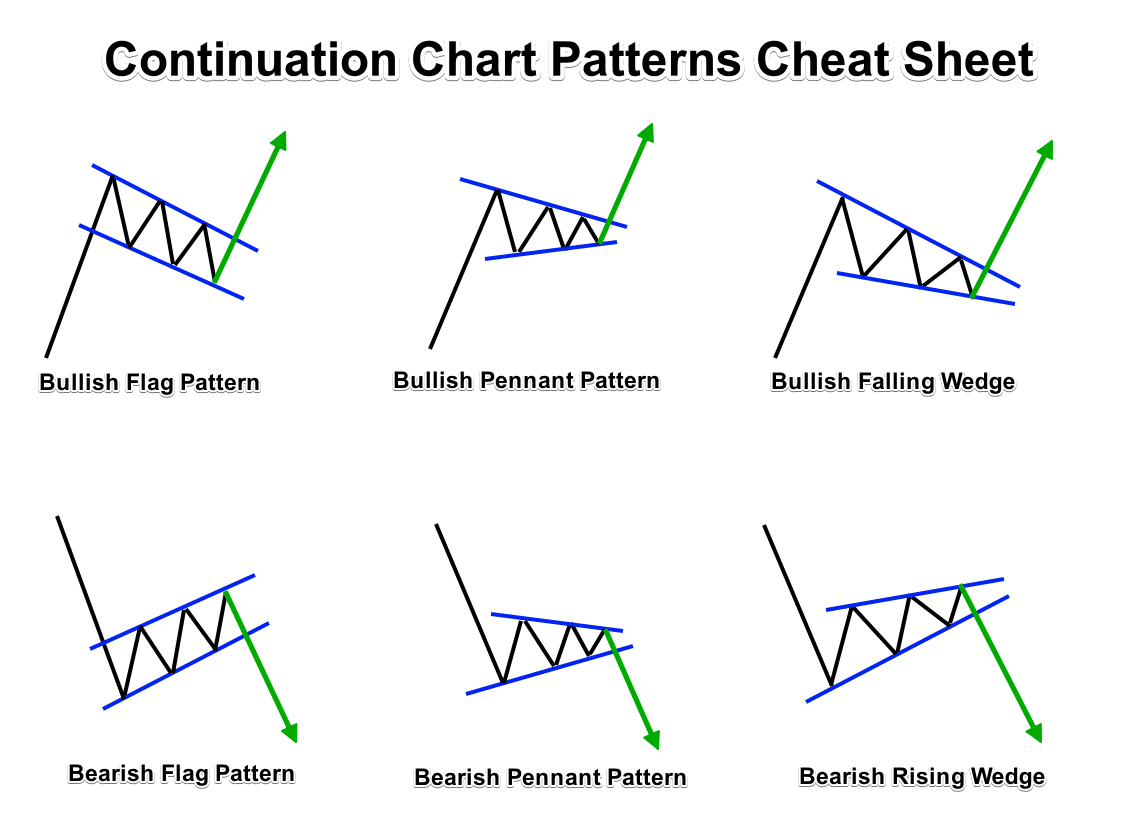

Forex trading patterns can be used to develop a variety of trading strategies. Trend following strategies involve identifying and trading in the direction of the prevailing trend, using patterns to confirm the trend and identify potential entry and exit points.

Breakout trading strategies focus on identifying and trading breakouts from support or resistance levels, with the assumption that the breakout will lead to a continuation of the trend.

Range trading strategies involve trading within a defined price range, using patterns to identify potential reversals or breakouts from the range. Each type of strategy has its own unique set of rules and risk management considerations.

Risk Management and Forex Trading Patterns

Risk management is essential in forex trading, and it is especially important when trading based on patterns. Stop-loss orders should be used to limit potential losses, and position sizing should be carefully considered to ensure that the trader is not risking too much capital on any one trade.

Traders should also consider the risk-reward ratio of each trade, ensuring that the potential profit outweighs the potential loss. By following sound risk management principles, traders can reduce their exposure to risk and increase their chances of long-term success.

Forex trading patterns provide valuable insights into market behavior, enabling traders to make informed decisions. To begin your forex trading journey, consider opening a forex account with a reputable broker.

This account will provide access to the necessary trading tools and platforms, allowing you to implement your strategies based on the identified trading patterns.

Advanced Techniques for Forex Trading Patterns

Advanced techniques for analyzing forex trading patterns include harmonic patterns, Elliott Wave Theory, and Fibonacci retracements. Harmonic patterns are based on the Fibonacci sequence and can be used to identify potential turning points in the market.

Elliott Wave Theory proposes that the market moves in a series of waves, and traders can use this theory to identify potential trading opportunities.

Fibonacci retracements are based on the Fibonacci sequence and can be used to identify potential areas of support and resistance. These advanced techniques can provide traders with additional insights into the market, but they also require a high level of skill and experience to use effectively.

Closing Summary: Forex Trading Patterns

Understanding and utilizing forex trading patterns is an essential skill for traders looking to enhance their profitability and minimize risk. By mastering these patterns, traders can gain a competitive edge in the dynamic and ever-changing forex market.

Forex trading patterns are an essential part of technical analysis, allowing traders to identify potential trading opportunities. However, these patterns can be difficult to interpret and apply consistently.

This is where Forex trading indicators come in. Indicators can help traders confirm patterns, identify trends, and predict future price movements, making them a valuable tool for any Forex trader.

By utilizing both patterns and indicators, traders can increase their chances of success in the Forex market.

Essential Questionnaire

What are the most common forex trading patterns?

Trendlines, support and resistance levels, and candlestick patterns are among the most commonly recognized forex trading patterns.

How can I identify forex trading patterns?

Technical indicators, chart analysis, and pattern recognition skills are essential for identifying forex trading patterns.

In the realm of Forex trading, patterns often hold the key to unlocking profitable opportunities. While technical analysis provides valuable insights into these patterns, Forex news trading adds another layer of complexity to the equation.

By understanding how news events can impact currency movements, traders can refine their pattern analysis and enhance their overall trading strategy.

How can I use forex trading patterns to develop trading strategies?

Forex trading patterns can be used to develop trend following, breakout trading, and range trading strategies, among others.

What is the role of risk management in forex trading based on patterns?

Risk management is crucial when trading based on patterns, involving the use of stop-loss orders, position sizing, and risk-reward ratios.

What are some advanced techniques for analyzing forex trading patterns?

Harmonic patterns, Elliott Wave Theory, and Fibonacci retracements are examples of advanced techniques used to analyze forex trading patterns.