Forex technical indicators are indispensable tools for traders, providing valuable insights into market behavior and empowering them to make informed decisions. From identifying trends to predicting price movements, these indicators offer a comprehensive understanding of the currency market.

As the backbone of technical analysis, Forex technical indicators have revolutionized the way traders navigate the complex world of currency trading.

By harnessing the power of historical data and mathematical formulas, these indicators help traders uncover patterns, anticipate market movements, and ultimately maximize their trading potential.

Forex technical indicators provide valuable insights into market trends, helping traders make informed decisions. When volatility spikes, as discussed in Forex volatility trading , technical indicators become even more crucial for identifying potential trading opportunities.

By understanding how volatility affects market behavior, traders can adjust their strategies accordingly and leverage technical indicators to capitalize on market fluctuations.

Overview of Forex Technical Indicators

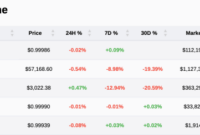

Technical indicators are mathematical tools used by Forex traders to analyze market data and make informed trading decisions. They help traders identify trends, predict price movements, and assess market sentiment.

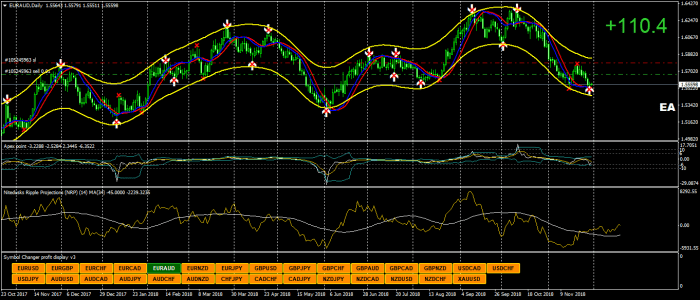

Forex technical indicators are a powerful tool for traders, providing insights into market trends and price movements. These indicators, which include moving averages,

Bollinger Bands, and relative strength index (RSI), can help traders identify potential trading opportunities and make informed decisions.

For a comprehensive overview of forex trading indicators, refer to Forex trading indicators. These indicators, when combined with fundamental analysis and risk management strategies, can enhance a trader’s ability to navigate the dynamic forex market and potentially increase their profitability.

Technical indicators can be classified into different types, including:

- Trend indicators

- Momentum indicators

- Volatility indicators

- Volume indicators

- Oscillators

Each type of indicator serves a specific purpose and can provide valuable insights into the market.

Types of Forex Technical Indicators

There are numerous technical indicators available to Forex traders. Some of the most common include:

| Indicator Name | Description | Formula |

|---|---|---|

| Moving Average | Calculates the average price of a currency pair over a specified period. | MA(n) = (P1 + P2 + … + Pn) / n |

| Relative Strength Index (RSI) | Measures the magnitude of recent price changes to evaluate overbought or oversold conditions. | RSI = 100 – 100 / (1 + RS) where RS = Average of Upward Price Changes / Average of Downward Price Changes |

| Bollinger Bands | Consist of three lines: a simple moving average and two standard deviation bands above and below the moving average. | Upper Bollinger Band = MA + 2σ Lower Bollinger Band = MA – 2σ |

| Stochastic Oscillator | Compares the closing price to the price range over a specified period to identify overbought or oversold conditions. | %K = 100 * (C – L) / (H – L) %D = 3-period moving average of %K |

Identifying and Using Technical Indicators, Forex technical indicators

Selecting the appropriate technical indicators depends on the trading strategy and market conditions. Traders should consider the following factors:

- Time frame

- Market volatility

- Trading style

- Risk tolerance

It is important to understand the limitations and potential pitfalls of technical indicators. They can provide valuable insights, but they should not be relied upon solely for trading decisions.

Forex technical indicators provide valuable insights into market trends, helping traders make informed decisions. While fundamental analysis focuses on economic data and events,

Forex news trading relies on real-time news and announcements to identify potential trading opportunities. By combining technical indicators with Forex news trading , traders can enhance their analysis and potentially increase their trading success.

Advanced Techniques for Using Technical Indicators

Advanced traders may employ various techniques to enhance the effectiveness of technical indicators:

- Combining multiple indicators

- Creating custom indicators

- Using indicators on different time frames

- Backtesting indicators on historical data

These techniques can provide traders with a more comprehensive view of the market and help them make more informed trading decisions.

Case Studies and Examples

Many successful Forex traders have used technical indicators to achieve positive results. For example:

- George Soros used the moving average and Bollinger Bands to identify trading opportunities during the 1992 Black Wednesday currency crisis.

- Bill Lipschutz used the relative strength index to predict the collapse of the Japanese yen in the early 1990s.

Best Practices for Using Technical Indicators

To use technical indicators effectively, traders should follow these best practices:

- Use multiple indicators to confirm signals.

- Set realistic expectations.

- Avoid overtrading.

- Manage risk carefully.

Limitations and Drawbacks of Technical Indicators

While technical indicators can be valuable tools, they have limitations:

- They are based on historical data and may not predict future price movements accurately.

- They can generate false signals, especially in volatile markets.

- They can lead to emotional biases if traders become overly reliant on them.

Final Wrap-Up: Forex Technical Indicators

In the dynamic and ever-evolving Forex market, technical indicators remain a cornerstone of successful trading. While they are not foolproof and have their limitations, when used wisely, they provide traders with a competitive edge, enabling them to navigate market fluctuations with confidence and achieve their financial goals.

Answers to Common Questions

What are the different types of Forex technical indicators?

There are numerous types of Forex technical indicators, each serving a specific purpose. Some common types include trend indicators (e.g., moving averages, Bollinger Bands), momentum indicators (e.g., Relative Strength Index, Stochastic Oscillator), and volatility indicators (e.g., Average True Range, Donchian Channels).

How do I choose the right technical indicators for my trading strategy?

Selecting the appropriate technical indicators depends on your trading strategy, risk tolerance, and market conditions. It’s essential to research different indicators, understand their strengths and weaknesses, and experiment with them to find the ones that align best with your trading approach.

Can technical indicators guarantee successful trades?

While technical indicators provide valuable insights, they cannot guarantee successful trades. They are tools that assist traders in making informed decisions, but market conditions can be unpredictable, and other factors, such as news events and economic data, can influence price movements.