Delve into the dynamic world of forex session strategy, where market behavior dances to the rhythm of global trading hours. Discover the intricacies of session volatility, session-based trading strategies, and cross-session opportunities to unlock the full potential of the forex market.

As the forex market pulsates with activity across different time zones, understanding session dynamics becomes paramount. From the bustling streets of Tokyo to the vibrant heart of London and the relentless pace of New York, each session brings unique opportunities and challenges.

Forex Session Strategy

Forex trading involves the exchange of currencies in a decentralized global market. Understanding the different trading sessions and their impact on market behavior is crucial for successful trading.

Session Overviews

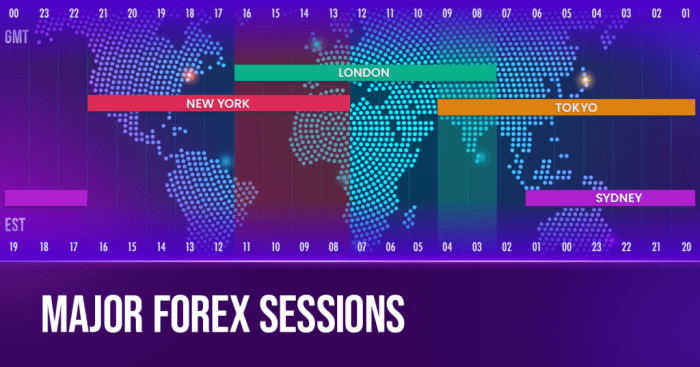

Forex trading sessions are periods during which the majority of trading activity takes place. There are three main trading sessions: Asian, European, and American.

Forex session strategy is a trading approach that focuses on identifying market opportunities during specific trading sessions. By understanding the unique characteristics of each session, traders can develop strategies tailored to those conditions.

One popular strategy for forex session trading is the MACD forex strategy , which utilizes the Moving Average Convergence Divergence (MACD) indicator to identify potential trend reversals and trading opportunities.

By incorporating the MACD forex strategy into their session-based trading approach, traders can enhance their decision-making and potentially improve their overall trading performance.

- Asian Session (10:00 PM – 7:00 AM GMT): This session opens with the Sydney market and closes with the Tokyo market. It is typically characterized by lower volatility due to fewer major economic releases.

- European Session (7:00 AM – 4:00 PM GMT): This session opens with the London market and closes with the Frankfurt market. It is the most active session, with high liquidity and volatility due to the release of important economic data and events.

- American Session (1:00 PM – 10:00 PM GMT): This session opens with the New York market and closes with the Chicago market. It is also a highly active session, with volatility influenced by economic news releases and geopolitical events.

Session Volatility

Volatility in forex trading refers to the degree of price fluctuations. Different trading sessions exhibit varying levels of volatility.

- Asian Session: Generally lower volatility due to reduced trading activity and fewer major economic releases.

- European Session: Higher volatility due to the release of key economic data, such as GDP figures and interest rate decisions.

- American Session: Volatility can be high, influenced by economic news releases, market events, and geopolitical developments.

Factors contributing to volatility include:

- Economic news releases

- Market events (e.g., earnings announcements)

- Geopolitical events

- Major central bank decisions

- Natural disasters

Session-Based Trading Strategies

Traders can develop strategies specifically tailored to the characteristics of each trading session.

- Asian Session: Focus on range trading strategies due to lower volatility and fewer market-moving events.

- European Session: News-based trading strategies can be effective due to the release of important economic data.

- American Session: Trend-following strategies can be suitable due to higher volatility and the potential for extended price movements.

Cross-Session Trading Strategies

Traders can also explore strategies that involve trading across multiple forex sessions.

When it comes to devising a Forex session strategy, it’s crucial to consider the impact of market conditions. Forex trading indicators can provide valuable insights into market sentiment, helping traders identify potential opportunities and mitigate risks.

By incorporating these indicators into their strategy, traders can gain a comprehensive understanding of market dynamics and make informed trading decisions during different Forex sessions.

- Carry Trade: Involves borrowing a currency with a low interest rate and investing in a currency with a higher interest rate, taking advantage of the interest rate differential.

- Overnight Trading: Holding positions overnight to take advantage of potential price movements during less active sessions.

- Scalping: Executing numerous small trades within a single trading session, taking advantage of short-term price fluctuations.

Session Correlation and Interdependence

Different trading sessions are interconnected, and market movements in one session can impact other sessions.

- Positive Correlation: Market movements in one session often align with movements in other sessions.

- Negative Correlation: Market movements in one session may be opposite to movements in other sessions.

- No Correlation: Market movements in one session may have no significant impact on other sessions.

Session-Specific Indicators and Tools, Forex session strategy

Certain technical indicators and tools can be particularly useful for analyzing and trading during specific forex sessions.

- Asian Session: Bollinger Bands, Moving Averages

- European Session: Relative Strength Index (RSI), Stochastic Oscillator

- American Session: Ichimoku Cloud, Fibonacci Retracements

Risk Management in Session-Based Trading

Effective risk management is crucial when trading during specific forex sessions.

- Position Sizing: Adjust position size based on session volatility and risk tolerance.

- Stop-Loss Orders: Place stop-loss orders to limit potential losses.

- Profit Targets: Set profit targets to lock in gains and manage risk.

- Trailing Stops: Move stop-loss orders as positions move in a favorable direction.

Session-Based Backtesting and Optimization

Traders should backtest and optimize their trading strategies based on specific forex sessions.

- Historical Data: Use historical data to test strategies and identify optimal parameters.

- Simulation: Simulate trading strategies using different session-specific conditions.

- Optimization: Adjust strategy parameters to improve performance based on backtesting results.

Last Point: Forex Session Strategy

Mastering forex session strategy is not just about timing trades; it’s about harnessing the collective wisdom of global markets. By aligning your strategies with the ebb and flow of session dynamics, you gain a competitive edge, navigating market movements with precision and maximizing your profit potential.

So, embark on this journey of session-based trading mastery, where knowledge and strategy converge to unlock the full potential of the forex market.

General Inquiries

What is the most volatile forex session?

Understanding Forex session strategy is crucial for successful trading. The strategy involves trading during specific time zones when market volatility and liquidity are high. For instance, the London session is known for its high volatility and liquidity, making it an ideal time to trade.

By incorporating Forex channel trading techniques within your session strategy, you can further enhance your trading outcomes. Forex channel trading involves identifying and trading within price channels, providing a structured approach to capitalize on market trends.

The London session, overlapping with the New York session, typically exhibits the highest volatility due to the convergence of major financial centers.

Can I trade forex during all sessions?

While the forex market operates 24/5, liquidity and volatility vary across sessions. Trading during major sessions (London, New York, Tokyo) is generally recommended for optimal conditions.

How do I identify session-based trading opportunities?

Analyze market behavior, economic news releases, and geopolitical events during specific sessions to identify potential trading opportunities. Technical indicators and chart patterns can also provide valuable insights.