Forex scalping techniques are a popular trading strategy that involves making numerous small trades throughout the day, each with the goal of capturing small profits. This fast-paced trading style requires traders to have a strong understanding of the market, technical indicators, and risk management.

Forex scalping techniques involve taking multiple small profits over short timeframes. One effective strategy for scalping is range trading, which involves identifying a specific price range and trading within those boundaries. By leveraging the Range trading strategy , scalpers can capitalize on price fluctuations within a defined range, maximizing their profit potential while minimizing risk.

In this comprehensive guide, we will delve into the intricacies of Forex scalping techniques, covering everything from the basics to advanced strategies. Whether you are a seasoned trader or just starting out, this guide will provide you with the knowledge and tools you need to succeed in this exciting and potentially lucrative trading style.

Forex scalping techniques can be greatly enhanced by incorporating a multi-timeframe strategy. By analyzing multiple timeframes simultaneously, traders can identify trends and patterns that may not be apparent on a single timeframe. This allows for more informed decision-making and the potential for increased profitability.

For a comprehensive guide on this strategy, refer to our article on Forex multi-timeframe strategy. By combining this strategy with effective scalping techniques, traders can improve their chances of success in the fast-paced world of Forex.

Forex Scalping Techniques

Scalping in Forex trading involves making numerous small trades within a short period, aiming to profit from minor price fluctuations. It requires quick decision-making and precise execution.

Forex Scalping Strategies

Scalping strategies vary depending on the trader’s risk tolerance and trading style. Some common approaches include:

- Range Trading: Identifying and trading within a defined price range.

- Trend Following: Scalping in the direction of an established trend.

- News Trading: Capitalizing on price movements caused by news announcements.

Technical Indicators for Scalping

Scalpers often rely on technical indicators to identify trading opportunities. Some suitable indicators include:

- Moving Averages: Identifying support and resistance levels.

- Oscillators: Measuring momentum and overbought/oversold conditions.

- Volume Indicators: Assessing market sentiment and liquidity.

Risk Management in Scalping

Risk management is crucial in scalping due to the high frequency of trades. Techniques include:

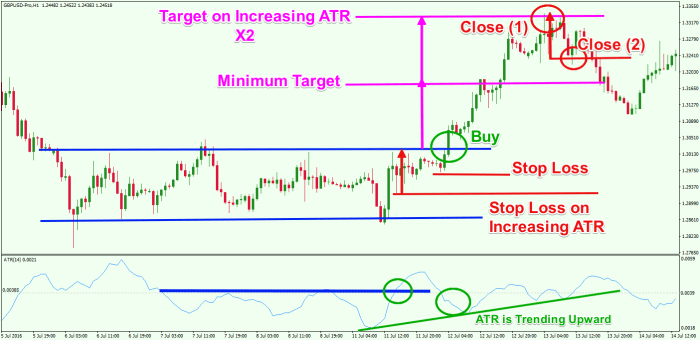

- Stop-Loss Orders: Limiting potential losses.

- Take-Profit Orders: Locking in profits at predefined levels.

- Position Sizing: Managing risk exposure based on account balance.

Trading Psychology for Scalpers, Forex scalping techniques

Scalping can be psychologically challenging due to its fast-paced nature. Developing a strong mindset involves:

- Discipline: Adhering to trading rules and avoiding emotional decision-making.

- Focus: Maintaining concentration and avoiding distractions.

- Patience: Waiting for suitable trading opportunities and avoiding overtrading.

Tools and Resources for Scalping

Essential tools for scalpers include:

- Trading Platform: Providing fast execution and advanced charting capabilities.

- Automated Trading Software: Automating trade execution based on predefined criteria.

- Reliable Data Feeds: Ensuring accurate and real-time market data.

Wrap-Up

Forex scalping techniques can be a highly rewarding trading strategy, but it also requires a great deal of skill, discipline, and risk management. By following the principles Artikeld in this guide, you can increase your chances of success and achieve consistent profits in the fast-paced world of Forex trading.

Forex scalping techniques involve executing numerous small trades over short time frames to capitalize on minor price fluctuations.

However, mastering these techniques requires a sound understanding of Forex trading psychology , as emotional discipline and mental clarity are crucial for success.

By controlling impulses and maintaining focus, traders can avoid common pitfalls and enhance their scalping strategies.

Helpful Answers: Forex Scalping Techniques

What is the difference between scalping and day trading?

Scalping involves making numerous small trades throughout the day, each with the goal of capturing small profits. Day trading, on the other hand, involves holding trades for longer periods of time, typically within a single trading day.

What are the most important technical indicators for scalping?

Some of the most popular technical indicators for scalping include moving averages, Bollinger Bands, and the Relative Strength Index (RSI).

How can I manage risk when scalping?

Risk management is crucial for scalping. Traders should use stop-loss orders to limit their losses and take-profit orders to lock in their profits.