Forex overbought oversold conditions present traders with unique opportunities to capitalize on market extremes. This guide delves into the intricacies of overbought and oversold markets, empowering traders with the knowledge and strategies to navigate these conditions effectively.

Understanding the dynamics of overbought and oversold markets is crucial for successful forex trading. This guide provides a comprehensive overview of the factors contributing to these conditions, equipping traders with the ability to identify them accurately.

Understanding the concept of overbought and oversold conditions in Forex trading is crucial for making informed trading decisions.

When a currency pair is overbought, it indicates that it may be due for a correction. Conversely, when a currency pair is oversold, it may present an opportunity for a potential reversal.

To mitigate the risks associated with these market conditions, traders often employ a Forex hedging strategy. This involves using financial instruments to offset the potential losses incurred from adverse price movements, thereby protecting traders’ capital and enhancing their overall trading performance.

Forex Market Dynamics

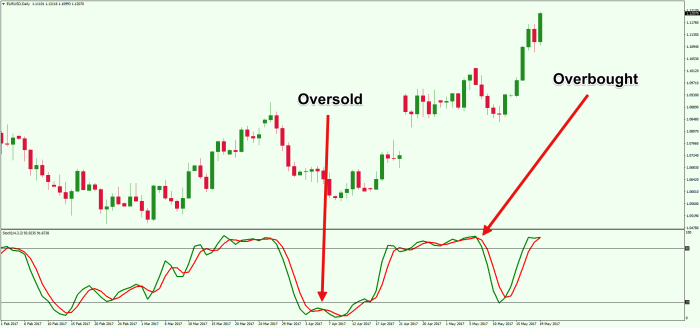

In forex trading, overbought and oversold conditions refer to market situations where an asset’s price is believed to have deviated significantly from its fair value. These conditions can be identified using technical analysis and can provide valuable insights for traders.

Overbought conditions occur when an asset’s price has risen rapidly and is considered to be overvalued. Oversold conditions, on the other hand, occur when an asset’s price has fallen sharply and is considered to be undervalued.

Factors that contribute to overbought and oversold conditions include:

- Strong market sentiment

- News events

- Technical factors, such as overbought/oversold indicators

Technical Indicators for Overbought and Oversold Conditions

Technical indicators are tools that traders use to analyze market data and identify potential trading opportunities. Several technical indicators can be used to identify overbought and oversold conditions, including:

- Relative Strength Index (RSI)

- Stochastic Oscillator

- Bollinger Bands

Each indicator has its own advantages and limitations. For example, the RSI is a momentum indicator that measures the speed and magnitude of price changes.

The Stochastic Oscillator is a momentum indicator that compares the closing price of an asset to its price range over a specific period. Bollinger Bands are a volatility indicator that measures the distance between an asset’s price and its moving average.

Trading Strategies Based on Overbought and Oversold Conditions, Forex overbought oversold

Traders can develop trading strategies that utilize overbought and oversold conditions to identify potential entry and exit points. One common strategy is to buy an asset when it is oversold and sell it when it is overbought.

In Forex, overbought and oversold conditions indicate potential market reversals. To mitigate risks during these periods, implementing a Stop loss strategy is crucial.

This technique allows traders to limit potential losses by automatically closing positions when the market moves against their favor.

By incorporating a Stop loss strategy into their trading plan, traders can protect their profits and manage risk more effectively, enabling them to navigate the overbought and oversold conditions in Forex.

Here is a step-by-step guide to a simple trading strategy based on overbought and oversold conditions:

- Identify an overbought or oversold asset using a technical indicator.

- Wait for the asset’s price to reverse direction.

- Enter a trade in the direction of the reversal.

- Set a stop-loss order to limit your risk.

- Take profit when the asset’s price reaches your target.

Risk Management and Overbought/Oversold Trading

Overbought and oversold trading can be a risky strategy. It is important to manage your risk carefully when trading in these conditions.

Some techniques for managing risk when trading in overbought and oversold conditions include:

- Using a stop-loss order to limit your risk

- Trading with a small position size

- Being aware of the potential for false signals

Psychology and Overbought/Oversold Trading

Overbought and oversold conditions can trigger strong emotions in traders. It is important to be aware of these emotions and to avoid making impulsive trades.

Forex overbought and oversold conditions can provide valuable insights into potential market reversals. Traders can combine these indicators with Forex news trading strategies to identify opportunities where news events may drive significant price movements.

By analyzing both technical and fundamental factors, traders can enhance their decision-making and potentially capitalize on market trends influenced by Forex overbought and oversold conditions.

Some tips for managing your emotions when trading in overbought and oversold conditions include:

- Stay disciplined and follow your trading plan

- Avoid trading when you are feeling emotional

- Take breaks when you need them

Advanced Concepts and Techniques

Traders can use a variety of advanced concepts and techniques to improve their accuracy when trading in overbought and oversold conditions.

Some of these concepts and techniques include:

- Combining multiple technical indicators

- Using price action analysis

- Trading with a contrarian approach

Closure: Forex Overbought Oversold

In conclusion, mastering the concepts of Forex overbought oversold conditions empowers traders to make informed decisions and execute profitable trades.

By understanding the market dynamics, utilizing technical indicators, and implementing sound risk management strategies, traders can navigate overbought and oversold markets with confidence and achieve consistent success.

Clarifying Questions

What are the key indicators of overbought and oversold markets?

Popular technical indicators used to identify overbought and oversold conditions include the Relative Strength Index (RSI), Stochastic Oscillator, and Bollinger Bands.

How can I develop a trading strategy based on overbought and oversold conditions?

A simple trading strategy involves buying when the market is oversold (RSI below 30) and selling when the market is overbought (RSI above 70). Adjust the RSI levels based on your risk tolerance and market conditions.

What are the psychological biases that can influence trading during overbought and oversold conditions?

Traders may experience confirmation bias, overconfidence, and fear of missing out (FOMO) during overbought and oversold conditions. It’s crucial to maintain a disciplined approach and avoid impulsive trading.