Embark on a journey into the realm of Forex multi-timeframe strategy, a powerful technique that empowers traders to decipher market trends, identify optimal entry and exit points, and mitigate risks with unparalleled precision. By analyzing multiple timeframes simultaneously, traders gain a comprehensive understanding of market dynamics, enabling them to make informed decisions and maximize their trading potential.

Multi-timeframe analysis provides a holistic view of the market, allowing traders to identify long-term trends, short-term fluctuations, and potential reversal points. It’s like having a crystal ball that reveals hidden opportunities and guides you towards profitable trades.

By integrating Forex trading patterns into a multi-timeframe strategy, traders can enhance their decision-making process. Forex trading patterns provide insights into market behavior, enabling traders to identify potential trading opportunities.

Incorporating these patterns into a multi-timeframe analysis allows traders to assess the market from different perspectives and increase the reliability of their trading signals.

Multi-Timeframe Analysis

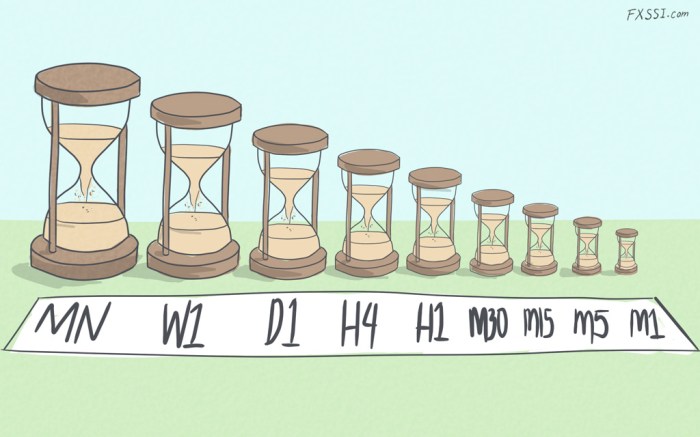

Multi-timeframe analysis involves examining price action across multiple timeframes to gain a comprehensive understanding of market trends and identify potential trading opportunities.

Commonly used timeframes include the daily, 4-hour, 1-hour, and 15-minute charts. Each timeframe provides a different perspective on the market, allowing traders to identify long-term trends, intermediate-term momentum, and short-term price movements.

By combining insights from multiple timeframes, traders can enhance their ability to predict future price movements and make informed trading decisions.

Identifying Market Trends

Higher timeframes, such as the daily or 4-hour charts, provide a broad view of the market and help identify long-term trends. By analyzing these timeframes, traders can determine the overall direction of the market and avoid trading against the prevailing trend.

Lower timeframes, such as the 1-hour or 15-minute charts, offer a more detailed view of price action and can help traders identify potential entry and exit points within the broader trend.

When using a Forex multi-timeframe strategy, it’s essential to incorporate Forex trading indicators to confirm and refine your trading decisions.

These indicators provide valuable insights into market trends, momentum, and volatility, helping you identify potential trading opportunities and manage risk more effectively.

By integrating trading indicators into your multi-timeframe analysis, you can enhance the accuracy and profitability of your Forex trading strategies.

Support and Resistance Levels

Support and resistance levels are crucial in multi-timeframe analysis as they represent areas where price action has repeatedly found resistance or support.

By identifying support and resistance levels on multiple timeframes, traders can gain a better understanding of the market’s overall structure and potential price movements.

For instance, a support level identified on the daily chart may provide a strong indication that price is unlikely to fall below that level on the lower timeframes.

Trading Strategies

A multi-timeframe trading strategy combines trend analysis and support and resistance levels to identify high-probability trading opportunities.

| Step | Action |

|---|---|

| 1 | Identify the long-term trend using higher timeframes (e.g., daily chart). |

| 2 | Look for potential entry points on lower timeframes (e.g., 1-hour chart) within the identified trend. |

| 3 | Use support and resistance levels to determine potential entry and exit points. |

| 4 | Set stop-loss orders below support levels and take-profit orders above resistance levels. |

| 5 | Manage risk by calculating risk-reward ratios and adjusting position size accordingly. |

Risk Management, Forex multi-timeframe strategy

Risk management is paramount in multi-timeframe trading. Traders should employ proper risk management techniques to protect their capital.

- Use stop-loss orders to limit potential losses.

- Calculate risk-reward ratios to ensure that potential profits outweigh potential losses.

- Adjust position size based on risk tolerance and account balance.

- Avoid overtrading and stick to a disciplined trading plan.

Final Summary: Forex Multi-timeframe Strategy

In conclusion, Forex multi-timeframe strategy is an indispensable tool for traders seeking to elevate their trading game. By mastering this technique, you’ll gain the edge you need to navigate market complexities, make sound trading decisions,

and consistently achieve your financial goals. Embrace the power of multi-timeframe analysis and unlock the full potential of the Forex market.

When executing a Forex multi-timeframe strategy, it’s crucial to consider Forex trading psychology. Understanding the psychological factors that influence trading decisions can help traders stay disciplined, manage risk, and avoid emotional biases.

By integrating psychological principles into their multi-timeframe analysis, traders can improve their decision-making and increase their chances of success in the Forex market.

FAQ Overview

What are the key benefits of using a multi-timeframe strategy in Forex trading?

Multi-timeframe analysis provides a comprehensive view of the market, enabling traders to identify long-term trends, short-term fluctuations, and potential reversal points.

This holistic approach enhances decision-making, reduces risks, and increases the probability of successful trades.

How do I identify support and resistance levels using multiple timeframes?

By analyzing multiple timeframes, traders can identify areas where price has consistently bounced or reversed. These levels act as support (when price bounces) and resistance (when price reverses), providing valuable insights into potential market movements.

What risk management techniques can I use with a multi-timeframe strategy?

Multi-timeframe analysis allows traders to assess risk across different timeframes. By understanding the overall market trend and potential short-term fluctuations, traders can implement risk management strategies such as stop-loss orders, position sizing, and hedging to minimize losses and protect their capital.