Forex momentum trading, a captivating strategy in the financial realm, beckons traders seeking to harness market momentum for profitable outcomes. In this comprehensive guide, we delve into the intricacies of momentum trading, empowering you with the knowledge and techniques to navigate the dynamic Forex market with confidence.

Momentum trading in Forex involves identifying and capitalizing on price trends, leveraging technical indicators and market analysis to pinpoint entry and exit points with precision. By understanding the psychology of momentum trading and employing effective risk management strategies, traders can mitigate potential pitfalls and maximize their trading potential.

Introduction

Forex momentum trading is a trading strategy that seeks to profit from the momentum of a currency pair’s price movement. Momentum traders believe that the trend is their friend and that by identifying and trading with the trend, they can increase their chances of success.

There are many different ways to identify momentum in the Forex market. Some of the most popular indicators include the moving average, the relative strength index (RSI), and the stochastic oscillator.

Identifying Momentum: Forex Momentum Trading

The moving average is a simple indicator that shows the average price of a currency pair over a specified period of time. The most common moving averages are the 50-day, 100-day, and 200-day moving averages.

The relative strength index (RSI) is a momentum indicator that measures the magnitude of recent price changes. The RSI is a bounded oscillator that ranges from 0 to 100.

A reading above 70 indicates that the currency pair is overbought, while a reading below 30 indicates that the currency pair is oversold.

The stochastic oscillator is a momentum indicator that measures the relationship between the closing price and the highest high and lowest low over a specified period of time.

The stochastic oscillator is a bounded oscillator that ranges from 0 to 100. A reading above 80 indicates that the currency pair is overbought, while a reading below 20 indicates that the currency pair is oversold.

Trading Strategies

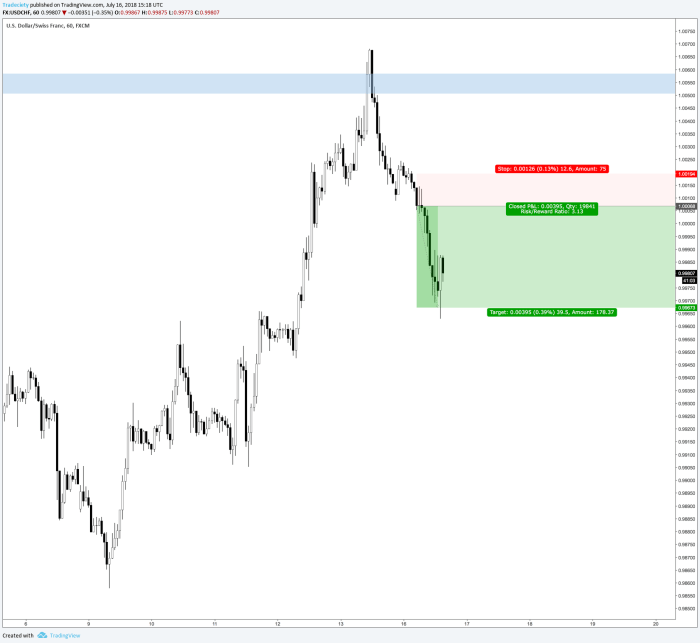

There are many different momentum trading strategies. Some of the most popular strategies include the trend following strategy, the breakout strategy, and the pullback strategy.

The trend following strategy is a simple strategy that involves buying a currency pair when it is in an uptrend and selling it when it is in a downtrend.

The breakout strategy involves buying a currency pair when it breaks out of a trading range. The pullback strategy involves buying a currency pair when it pulls back from a high or selling it when it pulls back from a low.

Risk Management

Momentum trading can be a profitable strategy, but it is also a risky strategy. The most common risks associated with momentum trading include the risk of a trend reversal, the risk of a false breakout, and the risk of a pullback.

The risk of a trend reversal is the risk that the trend will reverse and the currency pair will move in the opposite direction. The risk of a false breakout is the risk that the currency pair will break out of a trading range but then reverse and move back into the range.

The risk of a pullback is the risk that the currency pair will pull back from a high or a low but then continue to move in the same direction.

Forex momentum trading involves capitalizing on price trends to maximize profits. Opening a forex account is the first step to participate in this market.

Open forex account and gain access to a wide range of currency pairs, allowing you to implement your momentum trading strategies and potentially generate substantial returns.

Psychology of Momentum Trading

Momentum trading can be a challenging strategy to trade. The most common psychological challenges associated with momentum trading include the fear of missing out (FOMO), the fear of losing money, and the fear of being wrong.

The fear of missing out is the fear of missing out on a profitable trade. The fear of losing money is the fear of losing money on a trade. The fear of being wrong is the fear of making a mistake and losing money.

Ending Remarks

Forex momentum trading presents a lucrative opportunity for traders seeking to harness market momentum for profitable outcomes. By mastering the strategies, understanding the psychological challenges, and implementing sound risk management practices, traders can navigate the dynamic Forex market with confidence and reap the rewards of this exhilarating trading approach.

Helpful Answers

What are the key indicators used to identify momentum in Forex trading?

Commonly used momentum indicators include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Stochastic Oscillator.

Forex momentum trading is a strategy that seeks to profit from short-term price movements. While it can be a profitable strategy, it is important to understand the risks involved. One of the main risks of forex momentum trading is that it can be difficult to identify the trend.

Forex trend trading is a more conservative approach that seeks to profit from longer-term price movements. It is generally considered to be less risky than forex momentum trading, but it can also be less profitable.

How can I mitigate risks associated with momentum trading?

Effective risk management strategies include setting stop-loss orders, limiting trade size, and diversifying your portfolio.

What are the psychological challenges of momentum trading?

Momentum trading can trigger emotions such as fear of missing out (FOMO) and overconfidence. Traders must cultivate discipline and emotional control to navigate these challenges.