Forex channel trading, a powerful strategy in the financial markets, empowers traders to identify and capitalize on price movements within defined channels. Understanding support and resistance levels, trend identification, and advanced trading techniques are key to unlocking the full potential of this profitable approach.

Channel Trading Overview

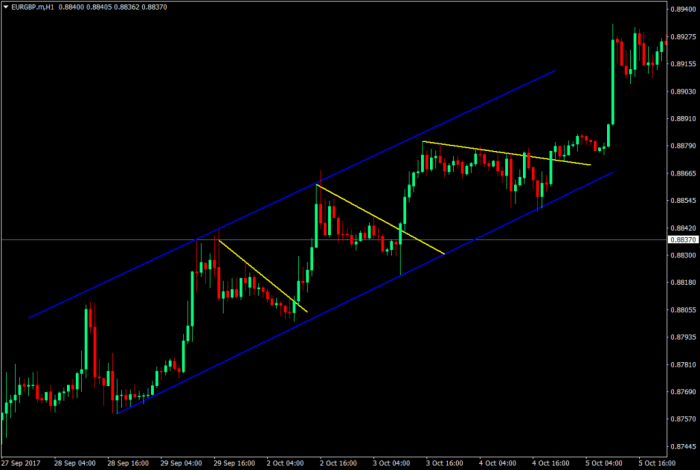

Channel trading is a technical trading strategy that involves identifying and trading within price channels. A price channel is a range of prices between two parallel lines, known as support and resistance levels.

Traders who use channel trading strategies aim to profit from price movements within the channel and from breakouts above or below the channel boundaries.

Forex channel trading involves identifying price movement within a defined range, allowing traders to capitalize on breakout opportunities. To maximize profits, setting appropriate Forex profit targets is crucial.

These targets help traders define their profit goals and manage risk effectively.

By considering market volatility and personal risk tolerance, traders can establish profit targets that align with their trading strategies, enhancing their chances of success in Forex channel trading.

Support and resistance levels are important concepts in channel trading. Support is a price level where the price of an asset tends to bounce back up, while resistance is a price level where the price tends to be capped.

Channels are formed when the price bounces back and forth between these two levels, creating a range-bound market.

Trend identification is also important in channel trading. Traders need to be able to identify the overall trend of the market in order to determine the direction of the channel. This can be done by using technical indicators such as moving averages or trendlines.

Identifying Forex Channel Trading Opportunities

There are a number of ways to identify potential trading channels in the Forex market. One common method is to use technical indicators such as the Bollinger Bands or the Ichimoku Cloud.

These indicators can help to identify areas of support and resistance, which can then be used to draw channel lines.

Another method for identifying trading channels is to look for price action patterns. For example, a trader might look for a series of higher highs and higher lows, which would indicate an uptrend channel. Conversely, a series of lower highs and lower lows would indicate a downtrend channel.

Volume analysis can also be used to confirm channel breakouts. When the price breaks out of a channel, it is often accompanied by a surge in volume. This indicates that there is strong interest in the market and that the breakout is likely to be sustained.

Trading Strategies for Forex Channels

There are a number of different trading strategies that can be used to trade Forex channels. One common strategy is to buy at support and sell at resistance. This strategy is based on the assumption that the price will continue to bounce back and forth between these two levels.

Forex channel trading involves identifying and trading within a defined price range. To manage the inherent risks associated with this strategy, it is crucial to adopt Forex risk management techniques. These techniques include setting stop-loss orders, determining position size, and diversifying trades to mitigate potential losses.

By implementing sound risk management practices, traders can enhance their chances of success in Forex channel trading while minimizing the impact of adverse market movements.

Another strategy is to trade breakouts. This strategy involves waiting for the price to break out of the channel and then trading in the direction of the breakout. Breakouts can be either bullish or bearish, depending on whether the price breaks out above or below the channel boundaries.

Risk management is an important part of any trading strategy. When trading channels, it is important to use stop-loss orders to protect your profits. Stop-loss orders are placed at a specific price level and will automatically close your trade if the price reaches that level.

Advanced Channel Trading Techniques

There are a number of advanced trading techniques that can be used to identify and trade channels. One common technique is to use Fibonacci retracement levels. Fibonacci retracement levels are a series of horizontal lines that are used to identify potential areas of support and resistance.

Another advanced technique is to use moving averages. Moving averages are a technical indicator that can be used to smooth out price data and identify trends. Moving averages can be used to confirm channel breakouts and to identify potential trading opportunities.

Advantages and Disadvantages of Channel Trading

Channel trading has a number of advantages. It is a relatively simple strategy to learn and implement, and it can be used to trade a variety of different assets.

However, channel trading also has a number of disadvantages. One disadvantage is that it can be susceptible to false breakouts. This can lead to losses if the trader is not careful.

Another disadvantage of channel trading is that it can be difficult to identify channels in a trending market. In a trending market, the price may not bounce back and forth between support and resistance levels, making it difficult to identify a trading channel.

Examples of Successful Forex Channel Traders

There are a number of successful Forex channel traders who have used this strategy to generate significant profits.

One example is Larry Williams. Williams is a well-known trader and author who has been using channel trading strategies for over 40 years. He has developed a number of successful trading systems, including the Williams %R indicator.

Another example of a successful Forex channel trader is Bill Williams. Williams is the author of the book “Trading Chaos.” He has developed a number of trading strategies, including the Alligator indicator.

Final Wrap-Up

Whether you’re a seasoned trader or just starting out, Forex channel trading offers a structured and potentially lucrative way to navigate the complexities of the currency markets. Embrace the strategies, techniques, and insights shared in this comprehensive guide to elevate your trading journey.

User Queries: Forex Channel Trading

What are the advantages of Forex channel trading?

Simplicity, profitability, and the ability to identify high-probability trading opportunities are key advantages.

How do I identify Forex channel trading opportunities?

Forex channel trading involves identifying and trading within price channels. It’s a popular strategy among traders who prefer a more structured approach. However, for those seeking a more dynamic approach,

Forex momentum trading may be a better fit. This strategy focuses on identifying and trading in the direction of the prevailing trend, offering the potential for larger profits.

Nevertheless, channel trading remains a valuable technique for traders looking to capitalize on range-bound markets and can be effectively combined with momentum trading for a comprehensive approach.

Look for parallel trendlines connecting support and resistance levels, confirmed by technical indicators like moving averages or Bollinger Bands.

What are some successful Forex channel trading strategies?

Trend following, breakout trading, and range trading are common and effective channel trading strategies.