Forex candlestick patterns are a powerful tool for traders, providing valuable insights into price action and potential market movements. From bullish to bearish, single to multiple, and in combination with technical indicators, these patterns offer a comprehensive approach to technical analysis.

Understanding and effectively utilizing candlestick patterns can significantly enhance your trading strategies, enabling you to make informed decisions and navigate market fluctuations with greater confidence.

1. Candlestick Patterns in Forex Trading

Candlestick patterns play a crucial role in Forex trading, providing valuable insights into market sentiment and price movements. They are graphical representations of price action over a specific time frame, depicting the open, close, high, and low prices.

2. Bullish and Bearish Candlestick Patterns

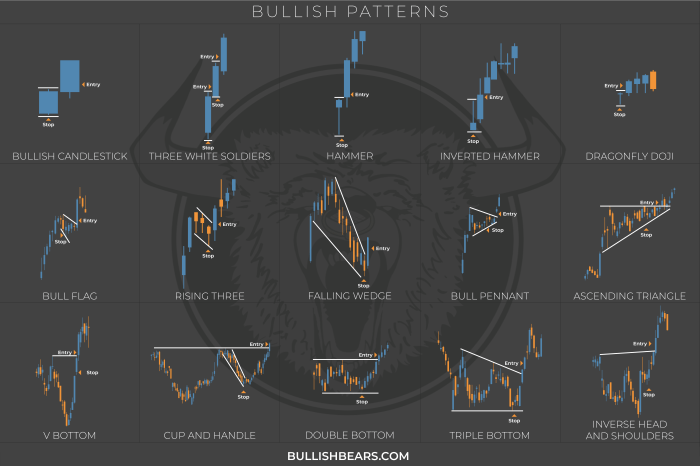

Bullish Candlestick Patterns

- Hammer: A small body with a long lower shadow, indicating potential bullish reversal.

- Bullish Engulfing: A large green candle that completely engulfs the previous red candle, suggesting a strong bullish trend.

- Piercing Line: A long green candle that opens below the previous red candle’s close and closes above its open, indicating a potential trend reversal.

Bearish Candlestick Patterns

- Hanging Man: A small body with a long upper shadow, indicating potential bearish reversal.

- Bearish Engulfing: A large red candle that completely engulfs the previous green candle, suggesting a strong bearish trend.

- Dark Cloud Cover: A red candle that opens above the previous green candle’s close and closes below its open, indicating a potential trend reversal.

3. Single and Multiple Candlestick Patterns

Single Candlestick Patterns, Forex candlestick patterns

Single candlestick patterns provide insights into short-term price movements. They include patterns like the hammer, hanging man, and shooting star.

Multiple Candlestick Patterns

Multiple candlestick patterns combine multiple candles to provide more reliable trading signals. They include patterns like the three white soldiers, three black crows, and morning star.

Forex candlestick patterns are a valuable tool for traders, providing insights into market trends and potential trading opportunities.

To get started with forex trading and harness the power of candlestick patterns, it’s essential to open a forex account. This allows you to access the market and execute trades based on your analysis of candlestick patterns and other technical indicators.

4. Combining Candlestick Patterns with Technical Indicators

Combining candlestick patterns with technical indicators enhances trading decisions by providing additional confirmation and insights. Common indicators used with candlestick patterns include moving averages, Bollinger Bands, and the Relative Strength Index (RSI).

5. Limitations and Cautions

While candlestick patterns are valuable tools, they have limitations and require careful interpretation. Traders should be aware of false signals, the importance of context, and the potential for subjectivity.

Final Wrap-Up: Forex Candlestick Patterns

In conclusion, Forex candlestick patterns are an invaluable asset for traders seeking to gain an edge in the fast-paced world of currency trading.

By mastering these patterns and incorporating them into your trading plan, you can improve your risk management, identify potential trading opportunities, and ultimately achieve greater success in the Forex market.

General Inquiries

What are the most common candlestick patterns?

Forex candlestick patterns offer valuable insights into market sentiment and price action. By recognizing these patterns, traders can make informed decisions about their positions. To stay ahead of the curve, it’s crucial to combine technical analysis with Forex news trading.

By monitoring economic events and market sentiment, traders can anticipate potential market movements and adjust their strategies accordingly.

Understanding candlestick patterns in conjunction with Forex news trading empowers traders to make calculated decisions and navigate the dynamic Forex market effectively.

Some of the most common candlestick patterns include the bullish engulfing pattern, the bearish engulfing pattern, the hammer, the hanging man, the morning star, and the evening star.

How do I use candlestick patterns to trade?

Candlestick patterns can be used to identify potential trading opportunities by providing insights into the market’s sentiment and momentum. Traders can use these patterns to determine entry and exit points, as well as to set stop-loss and take-profit levels.

Forex candlestick patterns offer valuable insights into price action, enabling traders to identify potential trading opportunities. However, it’s crucial to remember the importance of Forex risk management when using these patterns.

By understanding risk management principles, traders can protect their capital and minimize potential losses, ensuring the longevity of their trading endeavors and allowing them to continue utilizing candlestick patterns effectively.

What are the limitations of candlestick patterns?

Candlestick patterns are not foolproof and should not be used as the sole basis for making trading decisions. They can be influenced by market noise and false signals, and they may not be reliable in all market conditions.