Delving into the intricate world of Elliott wave analysis, we embark on a captivating journey to unravel the secrets of market behavior. This powerful technical analysis tool empowers traders and investors alike with the ability to decipher market trends and anticipate future price movements, offering a unique perspective that has captivated financial enthusiasts for decades.

Elliott wave analysis is a technical analysis technique that attempts to predict future price movements by identifying patterns in the price action. It is based on the idea that the market moves in waves, and that these waves can be identified and used to predict future trends.

Forex trend trading is a trading strategy that attempts to profit from the trend in the market. Trend traders typically buy when the market is trending up and sell when the market is trending down.

Elliott wave analysis can be used to identify potential trend reversals, which can help trend traders to make more informed trading decisions.

Elliott wave analysis, developed by Ralph Nelson Elliott in the 1930s, is a form of technical analysis that identifies recurring patterns in market data, known as waves.

These waves are believed to represent the collective psychology of market participants and can provide valuable insights into market sentiment and future price direction.

Elliott wave analysis, a popular technical analysis tool, can be enhanced by incorporating Forex trading indicators. These indicators provide additional insights into market trends and can help traders identify potential trading opportunities.

By combining Elliott wave analysis with Forex trading indicators, traders can gain a more comprehensive understanding of market behavior and make more informed trading decisions.

Historical Overview

/elliott-wave-tricks-to-improve-trading-4153295_FINAL-3500ecb730a84818b040c75f73a1fa98.png?w=700)

Elliott wave analysis is a technical analysis technique that attempts to predict future price movements by identifying repeating patterns in the financial markets. It was developed by Ralph Nelson Elliott in the 1930s and has since gained popularity among traders and investors.

Fundamental Principles

Elliott wave analysis is based on the following principles:

- The market moves in waves.

- Waves are fractal in nature, meaning that they repeat themselves at different scales.

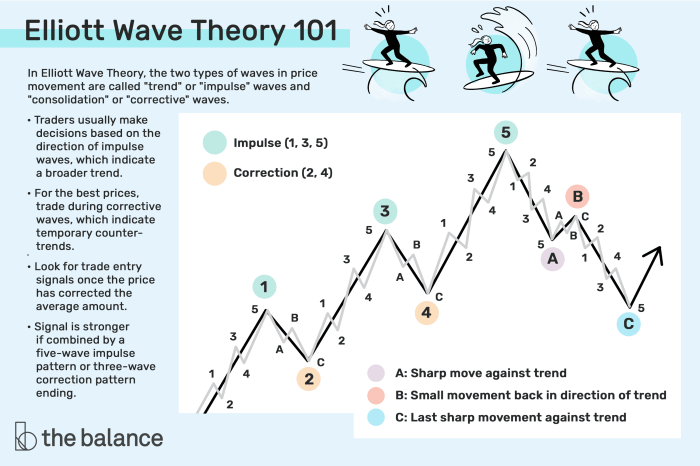

- Waves can be classified into two types: impulse waves and corrective waves.

- Impulse waves move in the direction of the trend and are composed of five waves.

- Corrective waves move against the trend and are composed of three waves.

Applications in Market Analysis

Elliott wave analysis can be used to identify market trends and predict future price movements. It is often used in conjunction with other technical analysis techniques, such as candlestick charting and Fibonacci retracements.

Elliott wave analysis, a technical analysis approach, can be applied to various financial markets, including Forex. Forex position trading , which involves holding positions for extended periods, can benefit from Elliott wave analysis by identifying potential market turning points.

By studying the wave patterns, traders can make informed decisions on when to enter and exit trades, aligning their positions with the underlying market trend.

Limitations and Criticisms

Elliott wave analysis is not without its limitations and criticisms. Some of the most common criticisms include:

- It is subjective and can be difficult to apply consistently.

- It can be difficult to identify waves in real-time.

- It can be difficult to predict the future direction of the market based on Elliott wave analysis alone.

Advanced Techniques, Elliott wave analysis

There are a number of advanced techniques that can be used to enhance the accuracy and precision of Elliott wave analysis. These techniques include:

- Fibonacci extensions

- Time cycles

- Gann analysis

Real-World Examples

Elliott wave analysis has been used successfully to predict a number of market events, including the stock market crash of 1929 and the dot-com bubble of the late 1990s.

Closing Notes: Elliott Wave Analysis

In conclusion, Elliott wave analysis stands as a formidable tool in the arsenal of technical analysts, providing a comprehensive framework for understanding market dynamics.

While it is not without its limitations, its ability to identify market trends and predict future price movements has made it a popular choice among traders and investors seeking to gain an edge in the ever-evolving financial markets.

FAQs

What is the basic principle behind Elliott wave analysis?

Elliott wave analysis is based on the idea that market prices move in a series of predictable patterns, known as waves. These waves are believed to represent the collective psychology of market participants and can be used to identify market trends and predict future price movements.

What are the different types of Elliott waves?

There are two main types of Elliott waves: impulse waves and corrective waves. Impulse waves are the primary trend-driving waves, while corrective waves are the counter-trend waves that move in the opposite direction of the impulse waves.

How can Elliott wave analysis be used to predict future price movements?

Elliott wave analysis can be used to identify potential turning points in the market. By identifying the current wave pattern, traders can anticipate the likely direction of future price movements.