Dividend stocks for early retirement offer a compelling path to financial independence, providing investors with a steady stream of passive income. These stocks can be a valuable asset in any retirement portfolio, offering the potential for growth, income, and reduced risk.

Dividend stocks can provide a steady stream of income for early retirees, but it’s important to diversify your portfolio with growth stocks as well. Growth stock portfolio diversification can help you generate long-term capital appreciation and potentially increase your overall returns.

By combining dividend stocks with growth stocks, you can create a more balanced portfolio that can help you achieve your financial goals.

In this guide, we’ll explore the benefits of dividend stocks for early retirement, how to identify and evaluate them, and strategies for maximizing dividend income. We’ll also provide case studies of investors who have successfully used dividend stocks to achieve financial freedom.

Understanding Dividend Stocks

Dividend stocks are equity investments that pay out a portion of the company’s profits to shareholders on a regular basis. Key characteristics include:

- Regular income stream for investors

- Potential for capital appreciation

- Reduced volatility compared to growth stocks

Dividend yield, calculated as annual dividends per share divided by stock price, indicates the percentage return on investment from dividends. Higher yields generally imply higher risk, while lower yields may indicate stability and reliability.

Dividend stocks are classified into various types, including:

- Growth stocks: Prioritize capital appreciation over dividend payments

- Value stocks: Offer high dividend yields relative to their market value

- Blue-chip stocks: Large, well-established companies with a history of consistent dividend payments

Benefits of Dividend Stocks for Early Retirement

| Investment Option | Dividend Stocks | Bonds | Real Estate |

|---|---|---|---|

| Income Stream | Regular and predictable | Fixed and less predictable | Variable and dependent on rental income |

| Growth Potential | Moderate to high | Low to moderate | Moderate to high |

| Volatility | Lower than growth stocks | Higher than dividend stocks | Variable depending on market conditions |

| Liquidity | High | Moderate | Low |

Examples of successful investors:

- David Swensen: Former Yale University Chief Investment Officer who used dividend stocks to generate high returns and retire early

- William Bernstein: Author and financial advisor who advocates for dividend stock investing for early retirement

Potential risks and rewards:

- Risks: Dividend payments can be cut or eliminated, especially during economic downturns

- Rewards: Regular income stream, potential for capital appreciation, and portfolio diversification

Identifying Dividend Stocks for Early Retirement

| Financial Ratio | Explanation |

|---|---|

| Dividend Payout Ratio | Percentage of earnings paid out as dividends |

| Dividend Yield | Annual dividends per share divided by stock price |

| Earnings Per Share (EPS) | Net income divided by number of outstanding shares |

| Price-to-Earnings Ratio (P/E) | Stock price divided by EPS |

| Debt-to-Equity Ratio | Total debt divided by total equity |

Step-by-step screening process:

- Identify companies with a consistent history of dividend payments

- Evaluate financial ratios to assess financial health and dividend sustainability

- Consider industry trends and competitive landscape

- Diversify portfolio across different sectors and company sizes

Tips for diversification:

- Invest in a mix of growth and value dividend stocks

- Consider investing in international dividend stocks

- Allocate a portion of portfolio to other asset classes (e.g., bonds, real estate)

Strategies for Maximizing Dividend Income

Dividend reinvestment plans (DRIPs):

- Automatically reinvest dividends into additional shares of the same stock

- Compounding effect increases dividend income over time

Tax-advantaged accounts:

- Invest in dividend stocks within retirement accounts (e.g., IRAs, 401(k)s) to defer or eliminate taxes on dividend income

- Consider Roth accounts for tax-free dividend income in retirement

Additional income strategies:

- Sell covered calls on dividend stocks to generate additional income

- Consider dividend ETFs that provide diversification and dividend yield

Case Studies of Dividend Stock Investors

Case Study 1:

For early retirement, dividend stocks can be a valuable asset. They provide regular income, which can help cover living expenses. However, it’s important to diversify your dividend stock portfolio to reduce risk. Diversifying a dividend stock portfolio means investing in a variety of companies across different industries and sectors.

This helps to ensure that your portfolio is not too heavily reliant on any one company or sector. By diversifying, you can reduce the risk of losing money if one company or sector underperforms.

- Investor: John Smith

- Investment Strategy: Invested in a diversified portfolio of dividend stocks, including blue-chip and growth companies

- Portfolio Allocation: 60% dividend stocks, 40% bonds

- Dividend Income: $20,000 per year

Case Study 2:

- Investor: Jane Doe

- Investment Strategy: Focused on high-yield dividend stocks

- Portfolio Allocation: 80% dividend stocks, 20% cash

- Dividend Income: $30,000 per year

- Challenges: Experienced dividend cuts during the financial crisis

Lessons learned:

While dividend stocks offer a steady income stream, growth stocks have the potential to significantly increase in value over time. For investors seeking long-term wealth creation, diversifying into best growth stocks to buy now can complement dividend stocks for early retirement.

By balancing the stability of dividend income with the growth potential of growth stocks, investors can potentially achieve a more comprehensive and rewarding retirement portfolio.

- Diversification is crucial to mitigate risk

- Consider both yield and financial health of companies

- Dividend stocks can provide a steady income stream for early retirement

Outcome Summary

Dividend stocks can be a powerful tool for early retirement, providing investors with a steady stream of income and the potential for long-term growth. By carefully selecting and managing a portfolio of dividend stocks, investors can increase their chances of retiring early and living a comfortable life.

General Inquiries

What are dividend stocks?

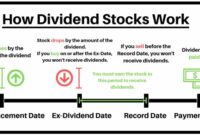

Dividend stocks are stocks of companies that pay a portion of their profits to shareholders in the form of dividends. Dividends can be paid quarterly, semi-annually, or annually.

What are the benefits of investing in dividend stocks for early retirement?

Dividend stocks offer several benefits for early retirement, including:

- Steady stream of passive income

- Potential for growth

- Reduced risk

- Tax advantages

How do I identify dividend stocks for early retirement?

There are several factors to consider when identifying dividend stocks for early retirement, including:

- Dividend yield

- Dividend growth rate

- Payout ratio

- Financial strength

- Industry and sector