Diversify Your Dividend Stock Portfolio – Investors seeking steady income often gravitate towards dividend-paying stocks. These stocks provide regular payouts and can be an effective strategy for building wealth over time. However, relying solely on dividend stocks exposes investors to sector or company-specific risks. This is where diversification becomes essential. Diversifying a dividend stock portfolio not only reduces these risks but also enhances the potential for long-term financial gains.

This guide explores the principles of diversification, key strategies, and best practices for building a balanced and robust dividend portfolio. By following these insights, investors can optimize returns, mitigate risks, and create a sustainable income stream over the long haul.

Table of Contents

ToggleThe Importance of Diversifying a Dividend Stock Portfolio

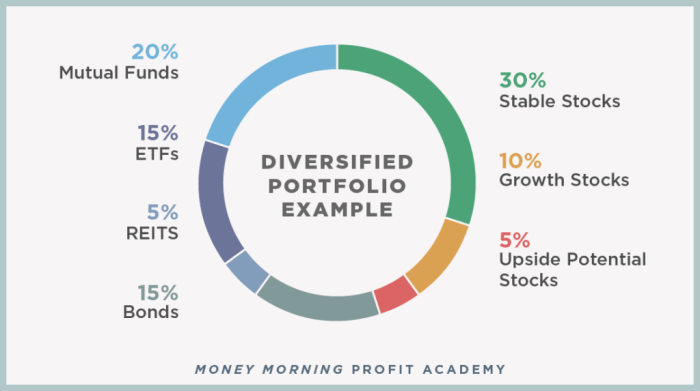

Diversifying a dividend stock portfolio involves spreading investments across different asset classes, sectors, and geographic regions. This strategy minimizes exposure to individual stock volatility, sector-specific downturns, and macroeconomic factors that can impact local economies. Diversification reduces the likelihood of significant financial losses by spreading risk more evenly, ensuring a more stable income stream.

Why Diversify?

- Risk Reduction: No single stock, sector, or region will perform well all the time. Diversification reduces the overall risk associated with a specific company or industry’s poor performance.

- Income Stability: Dividends provide a consistent income, but economic downturns or company-specific issues can lead to dividend cuts. A diversified portfolio helps ensure that income streams remain stable even if one or two stocks falter.

- Enhanced Growth Opportunities: Incorporating different types of stocks, including growth stocks, in addition to dividend payers, allows investors to capture gains from various sectors and markets, increasing overall returns.

Key Diversification Strategies for Dividend Stock Portfolios

Effective diversification requires a thoughtful approach. Here are the key methods investors should consider:

Asset Class Diversification

While dividend stocks are a crucial component of a portfolio, diversifying across multiple asset classes helps balance risk and reward. In addition to dividend-paying stocks, consider allocating investments in:

Bonds: Provide steady, fixed income with less volatility compared to stocks.

Real Estate Investment Trusts (REITs): Offer high dividend yields and exposure to real estate markets.

Commodities: Hedge against inflation and provide diversification away from equity markets.

Sector Diversification

Different industries perform well at different times in the economic cycle. By spreading investments across multiple sectors, investors reduce the risk associated with downturns in a specific industry.

Defensive Sectors: Include industries like utilities and consumer staples, which provide consistent income even during economic downturns.

Cyclical Sectors: Technology, financials, and industrials often perform well during periods of economic expansion, providing higher growth potential.

Geographic Diversification

Investing in companies from various regions, including international markets, can reduce exposure to country-specific risks such as political instability or economic recession. For instance:

U.S. Dividend Stocks: Offer stability and established payout histories.

Emerging Markets: Provide growth opportunities and higher dividend yields but may involve greater risk.

Risk Management in a Diversified Dividend Portfolio

Diversification is a key risk management tool, but it should be combined with other risk-reducing strategies to ensure the portfolio’s long-term success.

- Portfolio Rebalancing

As markets shift, some stocks in a portfolio may perform better than others, causing an imbalance. Regularly rebalancing ensures that asset allocations remain in line with the investor’s risk tolerance. For instance, if one sector becomes overweight due to rapid gains, selling a portion of those assets to reinvest in underperforming sectors can restore balance.

- Risk Assessment of Individual Stocks

Not all dividend-paying stocks are created equal. Investors should assess the risk-reward profile of individual companies before adding them to a portfolio. Factors to consider include:

- Dividend Payout Ratio: A higher payout ratio may indicate that the company is paying out more than it can afford, which could lead to future dividend cuts.

- Earnings Stability: Companies with a history of steady or growing earnings are more likely to maintain or increase their dividend payouts over time.

Sector Allocation: Balancing Growth and Stability

When constructing a diversified dividend portfolio, sector allocation plays a crucial role. Certain sectors, such as utilities and consumer staples, are known for their consistent dividends. However, these sectors may offer limited growth opportunities compared to more cyclical sectors like technology or financials.

- Defensive Sectors: Companies in sectors like utilities, healthcare, and consumer staples are less sensitive to economic cycles. These sectors tend to provide stable dividend income even in downturns.

- Cyclical Sectors: Technology and financial sectors typically offer higher dividend growth potential but are more sensitive to economic conditions. These sectors may experience greater volatility, but their long-term growth potential can enhance overall portfolio returns.

Considerations for Sector Allocation:

- Dividend Growth Potential: Focus on sectors with companies that consistently grow their dividends.

- Economic Sensitivity: Defensive sectors perform well in economic slowdowns, while cyclical sectors outperform during economic growth.

- Long-Term Trends: Keep an eye on industries poised for future growth, such as renewable energy or biotechnology.

Selecting the Right Companies

Company selection is paramount to building a strong dividend portfolio. Here are key factors to consider when selecting dividend-paying companies:

- Dividend History and Sustainability

Look for companies with a track record of consistent dividend payments over the years, as well as those with the ability to continue paying or increasing dividends. This can indicate financial strength and management’s commitment to returning capital to shareholders. - Financial Health

Analyze a company’s balance sheet, cash flow, and income statement to ensure it has the financial strength to sustain and grow its dividend payouts. Companies with strong cash flow and low debt are less likely to cut dividends during economic downturns. - Dividend Yield and Growth Potential

While high dividend yields can be attractive, they may also signal potential risk if the payout is unsustainable. A moderate yield with consistent dividend growth often indicates a more stable investment.

Tax Implications of Dividend Income

Understanding the tax implications of dividend income is crucial for maximizing after-tax returns.

- Qualified Dividends: These are taxed at a lower rate than ordinary income. To qualify, the dividends must be paid by a U.S. company or a qualified foreign corporation, and investors must meet specific holding period requirements.

- Non-Qualified Dividends: These are taxed at ordinary income tax rates, which are typically higher than those for qualified dividends.

- Tax-Advantaged Accounts: Holding dividend stocks in tax-advantaged accounts such as IRAs or 401(k)s can help minimize tax liabilities, allowing dividends to grow tax-free or tax-deferred.

Monitoring and Adjusting the Portfolio

Once a diversified dividend portfolio is established, ongoing monitoring and adjustments are necessary to ensure continued success.

- Performance Tracking: Regularly compare portfolio performance to relevant benchmarks and make adjustments when necessary.

- Dividend Monitoring: Keep an eye on dividend yields and growth rates to ensure income stability.

- Risk Management: Regularly reassess the portfolio’s risk profile and make adjustments to maintain a desired level of diversification and exposure to high-quality dividend stocks.

Conclusion: Building a Resilient Dividend Portfolio

Diversifying a dividend stock portfolio is a key strategy for reducing risk and enhancing returns. By spreading investments across asset classes, sectors, and geographic regions, investors can mitigate the impact of market volatility and downturns in specific industries or companies. Coupling dividend stocks with growth stocks can further enhance portfolio performance by capturing capital appreciation opportunities. Ultimately, the goal is to build a robust, income-generating portfolio that can weather various market conditions and deliver long-term financial success.